$1,000 Personal Loans For Good & Bad Credit

Get personalized rates in 60 seconds for a $1,000 loan with no impact to your credit score

How much would you like to finance?

$1K Loans for Good or Bad Credit - No Credit Check

Small personal loans are offered by more lenders than large personal loans. Therefore, when it comes to getting a $1,000 personal loan, you may have more options. With more options, you may get more competitive offers. Ultimately what the best personal loan is will depend on what you qualify for. To choose with confidence, check offers. Online lenders can offer competitive offers, fast funding, and a great deal of convenience, but you may also want to check with local banks and credit unions.

How do you compare $1k loans?

Comparing loan offers is more complicated than comparing the price of bread. While you can browse advertised rates, getting prequalified is the best way to determine what real offers are available. To compare $1,000 personal loan offers from top national lenders, visit Acorn Finance. Within 60 seconds or less you can receive personalized offers with no impact to your credit score.

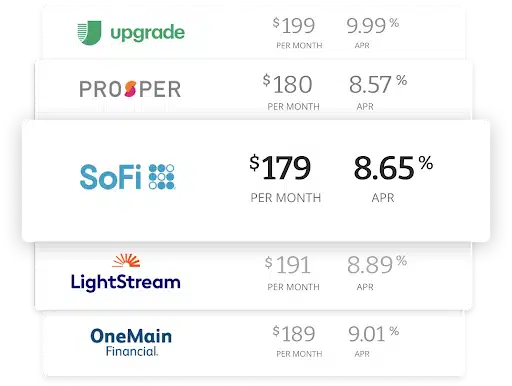

Compare rates from top lenders

Frequently Asked Questions

Most $1,000 personal loans are funded as a lump sum minus any fees. Before receiving funding, you will want to review your loan offer. Your loan offer will define the predetermined repayment period, interest rate, and other fees associated with the loan. Most personal loans are rapid on a monthly basis with a fixed monthly payment with interest.

Are $1k loans worth it?

A personal loan can be a smart choice if you need to borrow $1,000. When you borrow money though, you should always consider the cost. Consider if the loan will help you, how the repayment will affect your budget, and what the total loan cost is. With the right information you can determine if a $1,000 personal loan is worth it or not.

What are the different types of $1,000 personal loans?

There are two main types of personal loans:

- Secured loans: Require collateral. If you default, lenders can seize collateral. Collateral can be in the form of personal assets such as equity in your home or a vehicle you own.

- Unsecured loans: Do not require collateral. Pose more risk for the lender, therefore, they may come with higher rates. Better option for a $1,000 loan in most cases.

What is the easiest type of $1,000 loan to get?

Loans that don't require collateral such as a personal loan are usually more accessible. Furthermore, personal loans in small amounts such as $1,000 come with simple payment options and fast funding times. At Acorn Finance you can check personal loan offers starting at $1,000, depending on credit score. Simply invest 60 seconds of your time to check offers and you'll be on the fast-track to getting the funds you need. Online lenders have a reputation of streamlining and expediting the personal loan process. Enjoy the freedom of engaging in a $1,000 personal loan from the comfort of your own home. Get started at Acorn Finance today!

How do I get a $1,000 personal loan online?

Online lenders offer a convenient loan process for borrowers that need money as soon as possible. The typical online loan process looks like this...

- Check rates in seconds. At Acorn Finance you can access loan offers from a network of trusted top national lenders with no credit impact.

- Choose the offer you desire. Now that you've invested the time to compare offers, you can make the right decision.

- Complete the application process with the lender. Branch off with the lender of your choice to complete the application process and finalize approval.

- Receive approval. Once you've completed the application process and submitted any documentation you can be approved for the loan.

- Receive funding. Our favorite part - the finish line! Work with the lender of your choice to receive funds. Our lending partners can fund loans in as little as 1-2 business days, although funding times can vary.

- Repay the loan. Just because you've received the funds, the process does not end. Now it's your turn to fulfill your obligation to repay the loan as agreed.

What credit score is needed to secure a $1,000 personal loan?

It depends on the lender's requirements. Lenders typically have requirements, including credit score, that must be met in order for applications to qualify for loans. Offers will be more likely to be returned for borrowers with fair, good, average, or excellent credit. Most lenders on the Acorn platform have a credit score cutoff of 600 or above.

What is the average interest rate/APR on a $1,000 personal loan?

While you may not want to hear it - APR will depend on what you qualify for. Sure, there are average but the average will look very different for a borrower with a 750 credit score versus a 600 credit score. All the more reason to compare offers based on your personal financials to determine what's fair. At Acorn Finance our lending partners can offer APRs as low as 4.49%, depending on credit score.

How much is the monthly payment on a $1,000 loan?

Monthly payments can vary depending on what a borrower qualifies for. To check real offers, you can get prequalified. Otherwise, you can utilize a payment calculator to estimate payments.

Example:

- Loan amount $1,000

- Interest rate 7.99%

- Repayment Period 12 months

- Estimate monthly payment $87

What can I do with my $1,000 personal loan?

What can't you do with a $1,000 personal loan might be a better question. Personal loans, similar to credit cards, can be used for just about anything. When your unsecured personal loan funds, you should receive a lump sum of cash deposited into your account.

Of course, you will have to repay the loan as agreed with fixed monthly payments. Most lenders do not have spending restrictions for personal loans, thus allowing borrowers to spend the funds on just about anything. Some common uses for personal loans include:

- Debt consolidation

- Wedding financing

- Home improvement financing

- Appliance financing

- Furniture financing

While these are some common uses for a personal loan, the choice is yours as to how the money is spent. Before you take out a personal loan you should have some idea of how you will spend the money.

Pro tip: Only borrow money that you need. When the money is initially deposited it may feel like free money, but it certainly won't feel free when the payments are due. Defaulting on a personal loan or any loan can damage your credit score. Borrow responsibly and within your means. If you make on-time payments and repay a personal loan on-time it can positively impact your credit score.

Can I get a $1,000 personal loan with no credit check?

You can access $1,000 personal loan offers quick with no credit check. If you wish to accept an offer though the lender will likely need to run your credit. Start by checking offers with no credit impact at Acorn Finance to determine if taking the next step is worth it. If you need $1,000 dollars now with no credit check then Acorn Finance can help today.

Can I get a $1,000 loan?

Yes, $1,000 personal loans exist and are accessible for most types of borrowers. Since this is a smaller loan amount, you may not need excellent credit to qualify. If you need to borrow $1,000 for a few weeks, you may be able to charge it to a credit card and pay the balance before your next statement.

However, if you need to borrow $1,000 for 6 or 12 months, or maybe longer, you may want to consider a personal loan. If you have credit challenges, you should be able to provide proof of income, if requested. In addition, you should have enough income to cover the monthly payment in addition to other living expenses. If you are considering a $1,000 personal loan, you will first need to find a lender that offers them. Most lenders have minimum and maximum loan amounts, and not all will offer small personal loans. At Acorn Finance, our lending partners can offer personal loans between starting at $1,000 and up to $100,000. At Acorn Finance, you can check personal loan offers within 60 seconds or less without impacting your credit score.

How can I get a $1,000 loan?

For small loan amounts such as $1,000, there are options available. Do your due diligence to understand the options and choose the one that works best for you. Options for a $1,000 loan can include the following:

- Payday loan: In some states, you may be able to take a $1,000 payday loan but it may not be the best option. Payday loans can charge borrowers extremely high APR. On average, payday loans charge 398% APR. Need we say anymore? A 398% APR may make your credit cards APR suddenly look ultra low.

- Credit card: The main benefit of a credit card is that you may already have one, making it most accessible. However, credit cards can lead to debt cycles that feel as if they'll never end. Swipe wisely and understand the APR associated with the card. If you have some time to spare, consider using a personal loan instead.

- Personal loan: In some cases, a personal loan can offer an even lower rate than your credit card. If you need to borrow $1,000 or more, you should consider a personal loan. Most banks, credit unions, and online lenders offer personal loans. However, if you are trying to compare offers while securing your loan quickly, you will probably want to use an online lender.

If you need $1,000 you may be considering a few loan options including a personal loan, payday loan, or credit card. Depending on how long you need to borrow the money, a credit card or personal loan may be the best options.

Is a $1,000 personal loan right for you? At Acorn Finance you can check personal loan offers from top national lenders without impacting your credit score. If you still feel the need to get other offers after checking offers at Acorn Finance, you should apply with the institution you bank at. Even with small loan amounts such as $1,000 it's important to make sure you find the most favorable rate and terms before committing.

How can I get a $1,000 dollar loan fast?

If you need a $1,000 loan fast, you should visit Acorn Finance. With the ability to check offers within 60 seconds or less, you will be on an expedited path to finding the most competitive personal loan offers. If you need $1,000 immediately, you may need to use an existing credit card. In some cases you can find same-day personal loans, but in most cases they will take at least 1-2 business days to fund, although funding times can vary. While needing money urgently is a stressful feeling and it may be hard to shift your focus away from the need you are trying to fulfill, take a deep breath and try to slow down. If you are in a financial pinch and need money fast, you may only make things worse by taking out an unfavorable loan or a loan you can't afford to repay.

Is it hard to get a $1,000 personal loan from a bank?

While banks are making an effort to advance technology and make processes more user-friendly, they are known for slow funding times and cumbersome application processes. Well-qualified applicants can expedite the $1,000 personal loan process from any lender, including a bank. However, borrowers with limited credit history or a bad credit score may be examined more closely, which can drag out the process. Generally speaking, the process of obtaining a $1,000 personal loan should be pretty simple and straightforward. With the popularity of personal loans growing, borrowers have more options available. To find out if you qualify for a personal loan, consider opening a new table and checking offers at Acorn Finance. Our network of top national lenders can help you find a $1,000 personal loan offer within 60 seconds or less, all with no credit impact.

How long will it take to pay back a $1,000 loan?

One of the perks of a personal loan is that you can choose the repayment schedule. As you compare offers, note how long the loan is. You'll notice that usually shorter loans have higher monthly payments, but may cost less overall. Find a loan offer that comes with a manageable monthly payment, but also a reasonable total APR. In summary, shop loan offers based on total cost, not just monthly payments.

If you use a credit card, you may have more time to repay the loan technically but it can cost substantially more. The domino effect can transpire from here as more debt accumulates your score can drop, thus increasing borrowing costs for future loans.

Does applying for a $1,000 loan impact credit?

At Acorn Finance, and some other platforms, you can check offers with no credit impact. If you choose to accept an offer, most lenders will need to do a hard credit check which can temporarily impact credit score negatively, as can taking out a new loan. Thinking forward, if you repay the loan on-time, you can boost your credit score with a $1,000 personal loan.

Can I borrow $1,000 from my bank?

Most banks offer personal loans. The amounts they are available in can vary, and you will need to qualify for your requested amount.

How easy is it to get a $1,000 loan?

Checking offers for personal loans is easy at Acorn Finance, that is if you qualify. With the ability to check offers with no credit score impact you can find out if and what you qualify for risk-free. Typically, smaller loan amounts have less strict requirements so more borrowers can qualify.

Who can benefit from $1,000 loans offered by Acorn Finance lending partners?

Acorn Finance connects borrowers to loan offers from a network of top national lending partners. Anyone in the market for a personal loan can benefit from checking offers at Acorn Finance. The ability to shop multiple loan offers in one place can increase your options, thus helping you find a competitive loan offer. Plus, our lending partners understand the competitive nature of our platform so they are more likely to leave their best offer on the table.

Is a $1K personal loan right for me?

Utilizing a personal loan can make sense for a number of reasons, although you'll be the ultimate determinant if it's right for you. You can use personal loans to consolidate debt, fund unexpected medical expenses, and even repair or improve your home. However, one key thing to remember is that you should only take loans when necessary. Make sure that you can comfortably afford monthly payments for the duration of your loan.. Start by checking offers at Acorn Finance to determine if a $1,000 personal loan is right for you!

You can also check with your bank or credit unions to see if they have options for lending to people with bad credit.

Why choose Acorn Finance for $1,000 Personal Loans

Get Started$1,000 Loan Calculator

Find the loan you're looking for

What can I do with a $1,000 personal loan?

Still have questions?

Learn More About $1,000 Personal Loans

If you’re not willing to risk your financial future in exchange for quick funds and high-interest rates, check offers today. Get loan offers for $1,000 at low APRs and convenient payment terms.

Acorn Finance is a lending platform that connects borrowers to a network of top national lenders. We help save borrowers time, with the intention of saving them money too. Simply input some personal information and receive personalized offers with no impact to your credit score. Found an offer you love? Work with the lender of your choice to finalize the approval process and receive funds in as little as 1-2 business days although funding times can vary. We make finding a competitive loan offer safe and quick, packaging everything you need in a nutshell.

Is it better to get a credit card or $1,000 personal loan?

It depends. If you can repay the $1,000 before the next statement or before interest is applied, a credit card may be the winning option. However, it can be harder to manage credit card repayment compared to a personal loan with fixed monthly payments. If you choose to borrow $1,000 with a personal loan you will know exactly how much you need to pay monthly and for how long. If you adhere to the repayment schedule, your loan will be paid in full.

In some cases a personal loan can offer lower APR than a credit card. However, you are in the driver seat of making sound financial decisions for yourself. Borrowing even as little as $1,000 with a high interest rate, can cost you much more than $1,000. You should always compare your options when it comes to borrowing money.

In addition, you may have a friend or family member that is willing to loan you $1,000 for a short period of time. It's usually best to reserve loans for larger amounts, but sometimes you might only need to borrow a little bit of money. Regardless of the route you choose, make sure you understand how the loan works. In addition, make sure you pay attention to any additional fees associated with the loan, not just the interest rate. The APR should disclose fees and interest charges associated with the loan.

Can you get a $1,000 personal loan with bad credit?

It's possible to qualify for a $1,000 personal loan with bad credit. Before doing so though, there are a few things you should know.

First, offers will be more likely to be returned for borrowers with fair, good, average, or excellent credit. Most lenders on the Acorn platform have a credit score cutoff of 600 or above.

Second, borrowing money may help you in the short-term, but if you are unable to repay the loan, it can cause more financial struggles down the road.

If you have bad credit, consider taking action to boost your credit score before borrowing money. On the other hand though, if you are able to qualify for a $1,000 personal loan with bad credit and repay it on-time it can boost your credit score.

In most cases a $1,000 personal loan is a short term loan. If you have bad credit you are asking a lender to take more of a risk, but you may be able to offset some of the risk with short repayment terms. If you are worried about your credit score, you can try to find a lender that specializes in fair credit or bad credit borrowing. A lender that specializes in fair or bad credit borrowers may give you the best chance of qualifying for a loan. Lenders that work with bad credit borrowers often consider factors such as education and job history, to maximize your chance of approval. However, if you can't prove healthy cash flows, you likely won't qualify for a loan of any amount. Regardless of your credit score, lenders need evidence that you have the ability to repay. Whether you choose to repay or not, that's another story.

If you opt to boost your credit score before applying for a loan, focus on the following elements:

- Debt-to-income ratio

- Payment history

- Length of credit history

- Credit mix

- Utilization (below 30% recommended)

How do you get a $1,000 personal loan with bad credit?

Now that we've covered it is possible to get a $1,000 personal loan with bad credit, you may be wondering how? Start by exploring lenders that offer personal loans and identify minimum credit score requirements. Most lenders on the Acorn platform have a credit score cutoff of 600 or above. If you think you might qualify, you can check offers at Acorn Finance with no credit impact or perhaps set a goal to achieve at least a 600 credit score and check offers. In the event you need to borrow money but don't qualify, consider applying with a co-signer.

What is the minimum credit score for a $1,000 personal loan?

Every lender has different requirements for minimum credit score, and some may have no requirement. Most lenders will want a credit score of at least 600, among other requirements that should be met. A credit score between 300 to 620, is usually classified as bad. If a lender doesn't share requirements, it may be worth your time to call and ask. Some lenders are not open to loaning money to borrowers with anything below excellent or good credit. While it's best to boost your credit score before borrowing money, a small personal loan that's repaid on-time or early can work to boost your credit score.

What is considered bad credit when looking for a $1,000 personal loan?

Credit score plays a big role in qualifying for a personal loan. For most lenders, credit score will be one of the first things considered.

Poor or bad credit is considered less than 580. However, just because you have a higher score than 580 does not mean you will get the loan you are applying for. Most lenders require you at least to be in the fair range, which is between 580-669. Even more so, lenders will want to see a score of at least 610-640. This is considered a below-average score, but in the end closer to the "good" range when it comes to credit.

Offers will be more likely to be returned for borrowers with fair, good, average, or excellent credit. Most lenders on the Acorn platform have a credit score cutoff of 600 or above.

If you are wondering what your credit score is, you might want to check with an online resource before you begin applying for a loan.

Here is a quick breakdown of credit scores and how they are calculated:

- 35% based on payment history

- 30% based on the total amount of outstanding debt

- 15% is based on the length of your credit history

- 10% based on new debt or newly opened lines of credit

10% based on credit mix (the number of your credit lines you have open including secured credit cards)

What lenders provide $1,000 personal loans for bad credit?

Finding a lender that works with borrowers that have bad credit is critical. However, keep in mind that these lenders are usually in the business of making money. They may see bad credit borrowers as an opportunity to charge outrageous interest rates and fees. If you can rebuild your credit before borrowing money, this is usually the best option. However, you may need to borrow money in the near future. Or perhaps you are taking out a small personal loan as a way to rebuild your credit. With bad credit, it is possible to get a $1,000 personal loan. While every lender is different, here are some lenders that are known for giving personal loans to people with bad credit:

- Avant

- LendingPoint

- Oportun

- Universal Credit

- OneMain

- Best Egg

- Upstart

SoFi

Best For: Online Personal Loans for Good to Excellent Credit Borrowers

For well-qualified borrowers, SoFi is a top choice for personal loans. Similar to LightStream, SoFi offers larger loans. With competitive offers though you may be able to borrow more. SoFi does not charge origination fees and offers extended repayment periods. As an Acorn Finance lending partner, you can access offers from SoFi and other competitive lenders through the Acorn Finance platform.

Minimum Qualifications:

- Minimum credit score requirement of 680 or above

- Minimum income requirement of $50,000/year

Pros of $1,000 Loans from SoFi:

- Flexible loan amounts and repayment terms

- No origination fees

- Competitive interest rates

- Funding as soon as one business day on approved loans, although funding times can vary

- Allows cosigner applications

- Unemployment protection available

Cons of $1,000 Loans from SoFi:

- High credit score requirement

- Approvals may take 3 days or more

Best Egg

Best For: Personal Loans for Borrowers with Fair Credit

Best Egg gives borrowers the chance to qualify for personal loans even without a perfect credit score. While Best Egg may not offer as much flexibility as other lenders, with fair credit you may not have as many options available. Best Egg can offer fast funding and competitive loan offers. Plus, they do not have a minimum income requirement. As an Acorn Finance lending partner, you can access offers from Best Egg and other competitive lenders through the Acorn Finance platform.

Minimum Qualifications:

- Minimum credit score requirement of 600 or above

- No minimum income requirement

Pros of $1,000 Loans from Best Egg:

- Fair credit scores can qualify

- No minimum income requirement

- Same or next day funding available, although funding times can vary

Cons of $1,000 Loans from Best Egg:

- Not available in some states

- Origination fees between 0.99% and 6.99%

- Higher APRs

Prosper

Best For: Peer-to-Peer Loans

Peer-to-peer loans cut out financial institutions. This can work to benefit borrowers by offering them more flexibility and opportunity. If you have credit challenges or lack of income (or provable income), you may want to consider a peer-to-peer lender such as Prosper. While Prosper may have limited repayment periods and charge an origination fee, they have less strict requirements compared to some other lenders. As an Acorn Finance lending partner, you can access offers from Best Egg and other competitive lenders through the Acorn Finance platform.

Minimum Qualifications:

- Minimum credit score requirement of 600 or above

- No minimum income requirement

Pros of $1,000 Loans from Prosper:

- Low threshold for credit score

- No minimum income requirement

- Flexibility to change payment dates

Cons of $1,000 Loans from Prosper:

- Long funding times

- Origination and late fees may apply

- No rate discount for autopay available

- Restrictive repayment periods

- Funding may take about 5 business days

Upgrade

Best For: Bad Credit Personal Loans

Upgrade offers a wide range of loan amounts with lenient requirements, thus allowing them to help borrowers with bad credit. If you have financial flaws, but need a personal loan, Upgrade may be a top contender for you to consider. With no collateral requirement and no down payment, you can get funding quickly without strings attached with Upgrade. As an Acorn Finance lending partner you can check offers from Upgrade and other top national lenders through the Acorn platform.

Minimum Qualifications:

- Minimum credit score requirement of 560 or above

- No minimum income requirement

Pros of $1,000 Loans from Upgrade:

- Low credit score requirement

- No early payoff penalty

- Joint applications allowed

- Funding as soon as one business day on approved loans, although funding times can vary

Cons of $1,000 Loans from Upgrade:

- Origination fees between 2.9% to 8%

- Higher APRs, especially for subprime borrowers

Axos Bank

Best For: Refinancing Existing Personal Loans

Axos bank has a higher minimum credit score requirement than some competitors, but they can offer generous loan amounts. Additionally, Axos Bank offers low origination fees. For borrowers with a solid credit score looking to refinance an existing personal loan in order to lock in a lower rate and payment, Axos Bank should be on your radar. As an Acorn Finance lending partner you can check offers from Axos Bank and other top national lenders through the Acorn platform.

Minimum Qualifications:

- Minimum credit score requirement of 700 or above

- Minimum income requirement $48,000/year

Pros of $1,000 Loans from Axos Bank:

- Low origination fees

- Mobile app to manage loans

- Fast funding times

- Funding as soon as one business day on approved loans, although funding times can vary

Cons of $1,000 Loans from Axos Bank:

- High credit score requirement

- Origination fee up to 2%

OneMain Financial

Best For: Borrowers with Less Than Perfect Credit That Need Fast Funding

OneMain Financial can help borrowers with less than perfect credit as well as low minimum annual income. While loan costs can be high, if you need to borrow money, OneMain Financial may be able to provide the funds you need. If the loan is managed responsibly and repaid on time you can take advantage of an opportunity to boost your credit score. With funding available in as little as one business day, although funding times can vary, OneMain Financial is a well-known lender that you should consider. As an Acorn Finance lending partner you can check offers from OneMain Financial and other top national lenders through the Acorn platform.

Minimum Qualifications:

- Minimum credit score requirement of 600 or above

- Minimum income requirement $7,200/year

Pros of $1,000 Loans from OneMain Financial:

- Low credit score requirement

- Offers secured loan option

- Low income requirement

- Flexibility to choose your payment date

- Fast funding times

Cons of $1,000 Loans from OneMain Financial:

- High interest compared to similar lenders

- Origination fee between 1% – 10% (or flat fee up to $500 depending on state)

LendingPoint

Best For: Fair Credit Personal Loans with Fast Funding

LendingPoint is another lender on our list that can work with borrowers with less than perfect credit. Plus, they can deliver funds quickly too. Borrowing with bad credit can be costly, but if repaid on time you can leverage the opportunity to boost your credit score. As an Acorn Finance lending partner you can check offers from LendingPoint and other top national lenders through the Acorn platform.

Minimum Qualifications:

- Minimum credit score requirement of 600 or above

- Minimum income requirement $30,000/year

Pros of $1,000 Loans from LendingPoint:

- Low origination fees

- Relaxed credit score and income requirements

- Same or next day funding available, although funding times can vary

Cons of $1,000 Loans from LendingPoint:

- No joint applications

- High loan costs

- Short repayment periods

LightStream

Best for: Home Improvement Loans

While LightStream is best for larger personal or home improvement loans, they are a top lender. With competitive offerings and large loan amounts available, you may be able to afford to borrow more with LightStream. As an Acorn Finance lending partner, you can access an offer from LightStream if you qualify through our platform. One of the biggest highlights of LightStream is NO origination fees and the fact that they allow applicants to apply with a co-signer.

Minimum Qualifications:

- Minimum credit score requirement of 660 or above

- Minimum income requirement of $50,000/year

Pros of $1,000 Loans from LightStream:

- No origination fees

- Funding as soon as one business day on approved loans, although funding times can vary

- Competitive loan offers

- Allows co-signer

- Large personal loans available

Cons of $1,000 Loans from LightStream:

- Strict qualification requirements

- No access to pre-qualify through the LightStream website (When applying directly, you can get pre-approved but not pre-qualified, therefore, you may be subject to a hard credit pull. To get pre-qualified with LightStream, check offers through Acorn Finance to see if you qualify.)

- No direct payment to creditors for debt consolidation loans

More Lenders:

Lending USA

Best For: Low Interest Personal Loans

Lending USA is a reputable lending platform that can help borrowers find low interest personal loans. From cosmetic surgery financing to pet loans, Lending USA can offer financing for a variety of industries. Additionally if you pay your loan off within six months no interest will be charged to the principal. With fast approval decisions and loans as small as $1,000 available, Lending USA is another lender to consider for a $1k personal loan. While they are not an Acorn Finance lending partner, you can visit their website to check offers.

Reprise Financial

Best For: Small Personal Loans with Fast Funding

Reprise financial can help borrowers find personal loan offers that meet their needs. In order to help borrowers obtain funds quickly, Reprise works to streamline the personal loan process. With customized payment options and fixed rates, check personal loan offers at Reprise Financial.

Universal Credit

Best For: Bad Credit Borrowers That Need To Build Credit

Because we all have to start somewhere, and some of us need the chance to start over, Universal credit strives to serve as many customers as possible. With a minimum credit score requirement of only 560, Universal Credit is a top choice for subprime borrowers. Borrowers with bad credit may pay higher loan costs and have fewer options, therefore, exploring as many lenders as possible that can work with you is important.

One home, endless possibilities