Personal Loans with Co-Signer For Good & Bad Credit

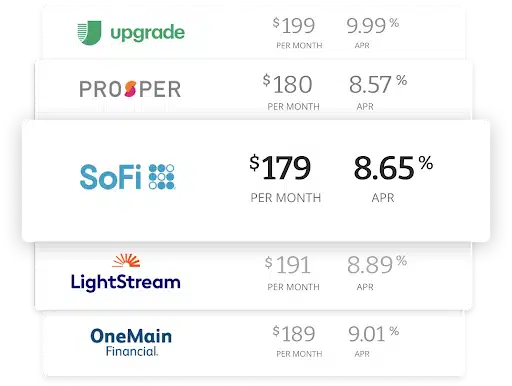

Compare monthly payment options from several lenders in under 2 minutes.

How much would you like to finance?

Fast, Same Day Options for Personal Loans with Co-Signer

In some cases, you may need a personal loan with a cosigner. If you have bad credit, a personal loan with a cosigner may be a smart option. If you need it fast or the same day then we are here to help.

Compare rates from top lenders

Learn More About Personal Loans with Co-Signer

A primary borrower and cosigner are equally responsible for the loan. However, when you apply for a loan with a cosigner you usually increase the applicant income, since now there are two incomes, and you may also increase your borrowing power. Ideally, a cosigner should have good credit. If you are thinking about applying for a personal loan with a cosigner, keep reading.

Read more - FAQ

+Do banks allow co-signers for personal loans?

Yes, of course, banks can allow borrowers to add a co-signer onto their personal loans. Having a co-signer may actually increase your chances of qualifying for a personal loan if you have no credit history or if you simply have bad credit. The co-signer is essentially volunteering to be responsible for the loan if you begin to fall behind on your payments or go into default. Banks are typically more willing to take a chance on a borrower with poor credit if they have a cosigner. It is vital however that you make all the necessary payments on time and in full. Someone who is willing to take on the role as a cosigner is taking on a large responsibility and if anything goes wrong, you may risk jeopardizing your relationship with that individual.

What are the advantages of having a co-signer?

There are numerous benefits to the borrower when they have a cosigner willing to sign onto a loan. For example, anyone who has poor credit may find that they can more easily qualify for financing when they have a cosigner with good to excellent credit. Not only can you more easily qualify for a personal loan with a cosigner, but you may also qualify for a larger sum and a potentially lower interest rate.

Can I get a personal loan with a cosigner if I have bad credit?

Yes, having a cosigner for a personal loan when you have bad credit may not only be a good idea, it may be necessary. Depending on what credit score you have, some lenders may not consider you for a personal loan if you have poor credit. By adding a cosigner onto the loan that has good or exceptional credit, your chances of qualifying may increase dramatically. It is important to note that you may seek a cosigner even if you have fair or good credit. Having a cosigner can help you find the most competitive interest rates available on the lending market. You could always prequalify on your own to see how much you could borrow and at what rates, and if you are not happy with the results, you can add a cosigner to increase the loan amount and possibly lower the interest rate as well.

Another benefit of having a cosigner is that you may get your money faster. Sometimes if your credit history is mediocre, lenders may ask for additional financial information and the loan process could get held up. Having a cosigner may help to prevent your loan application from getting flagged for further review, therefore expediting the approval and funding process.

Is it better to apply for a loan with a co-signer?

Depending on your credit history, it is not always better to apply for a loan with a cosigner. You may qualify for a better interest rate, however, if you default for any reason like for example, job loss, unexpected medical expenses, etc. You are now putting your cosigner in an awkward position of paying the loan on your behalf or face damage to their credit. The bottom line is, though there may be some benefits for the borrower to have a cosigner, are those benefits really worth the risk that a potential cosigner would have to take on? If you have decent credit, it may be a better option to take on a personal loan without a cosigner, even if the interest rate is a few points higher.

Is it easy to get a loan with a co-signer?

The only thing that is more complicated about getting a loan with a cosigner is the additional paperwork. In general, it actually is much easier and the process can be expedited if you have a signer with excellent credit. Lending institutions will value the safety net backup plan, the security of the cosigner, and also they may appreciate the fact that someone is willing to vouch for you, even if you have poor credit.

Does having a co-signer hurt your credit?

No, having a cosigner does not negatively impact your credit. On the contrary, it can actually help you build your credit if you have no credit or you are a poor credit borrower. A cosigner may help you qualify for a personal loan that can reflect positively on your credit history as long as you make all the monthly payments on time and in full. There is a risk to the credit profiles of both the borrower and the cosigner if the payments are not met or if the loan goes into default.

How does a co-signer affect the interest rate?

In most circumstances, the addition of a cosigner may help a borrower qualify for a loan with much lower interest rates than what they could qualify for on their own. The added security of a cosigner allows a lender to be more flexible with what kind of APR they will charge.

What credit score does a co-signer need for a personal loan?

Although there really is not a minimum credit score requirement for a cosigner, you do want a cosigner who has a credit score much higher than yours. Typically, a cosigner should have a minimum credit score of 670 or higher. Each lender will have its own requirements, but you generally will need a cosigner who has a decent credit score and a proven history of making on-time payments.

Does my credit matter if I have a cosigner?

Anytime you are seeking a personal loan, lenders are going to consider your credit history, even if you have a cosigner. A cosigner will without a doubt help in the long run, however, banks are still going to look at your credit profile and take special note of any red flags. Red flags such as recent bankruptcies, home foreclosures, or car repossessions are going to make any lender wary of loaning you money, even with the backing of cosigner. However, if you have any of these red flags, it does not automatically mean that you cannot qualify.

Does a co-signer need proof of income?

Yes, cosigners will undergo the same kind of financial scrutiny that a borrower would face when applying for a personal loan on their own. Lenders may look at a co-signer's credit report, their debt-to-income ratio, and they may even request additional information relating to their spending habits.

How much can I borrow with a co-signer?

There is no guaranteed amount that you can borrow with a co-signer. The amount you qualify for will likely depend on what a lender can offer and what you qualify for. What you qualify for with or without a cosigner usually depends on factors such as credit score, income, debt-to-income ratio, and more.

Closing Thoughts

Applying for a personal loan with a cosigner can give you many advantages. While you may want to try to qualify on your own first, you may find out that adding a cosigner works to your benefit. At Acorn Finance you can check personal loan offers with or without a cosigner without impacting your credit score. Our network of top national lenders can offer some of the most competitive personal loans. The Acorn Finance platform is designed to help consumers find the best loan offer while saving time and money.

Related articles:

Personal Loan Calculator

Find the loan you're looking for

What can I do with a $1,000 personal loan?

Still have questions?

One home, endless possibilities