Personal Loans With A Co-Signer

Compare monthly payment options from several lenders in under 2 minutes.

How much would you like to finance?

Co-Signer Personal Loan Options, Rates & More

There are several reasons you may think you need to apply for a personal loan with a cosigner. Depending on what circumstances you are in, financial worries can only exacerbate stress and make everything seem much worse. If you find yourself struggling to pay your bills, falling behind in credit payments, or could use a little extra freedom, then you may need to apply for a personal loan. Maybe you need access to cash, or maybe you need to consolidate your debt. Personal loans can help alleviate financial stress and, in some cases, be considered as good debt. You may have considered a personal loan before but have always been too fearful of denial to apply.

Sometimes because of past unforeseen events or things you couldn’t plan for, a personal loan with your credit history might be tough to get approved for. Luckily, if you have someone in your life that can lend a helping hand, finding a cosigner with a certain credit history criterion may improve your chances for approval from a lender.

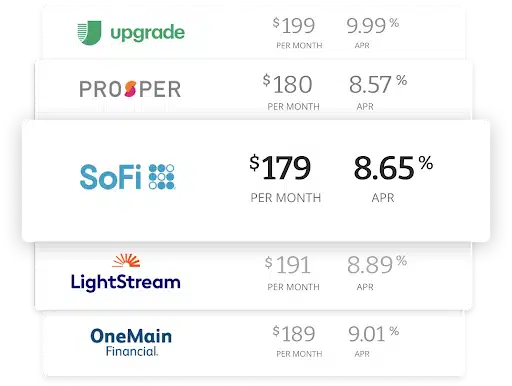

Compare rates from top lenders

Learn More About Personal Loans With A Co-Signer

So how do you apply for a personal loan with a cosigner? Can you apply for a personal loan with bad credit with a cosigner? Where can you find the best personal loans with a cosigner? Keep reading to learn more about applying and securing a personal loan with a cosigner.

Read more - FAQ

+What loans can I get with a cosigner?

- Unsecured personal loans

- Secured loans.

- Fixed-interest personal loans

- Variable-interest personal loans

- Debt consolidation personal loans

- Auto loans

- Can I get approved for a loan with a cosigner?

How is a cosigner's credit affected?

Is it better to apply for a loan with a cosigner?

There are a few things to consider while debating on whether to find a cosigner for your loan:

- What is the purpose of the loan?

- Can you guarantee your ability to repay the loan that is offered?

- Is your cosigner's credit in a strong position?

- Does your cosigner have the income statements to back up the personal loan request?

- Has your cosigner gone through bankruptcy?

- Is your cosigner a relative or a close friend?

- What industry are they employed in?

- Will their credit factors help or negate your chances of approval?

Make sure to know all these different things and more while considering getting someone to co-sign on your loan.

All personal loans need to be repaid within the framework provided by the lending institution, and the last thing you want is to negatively impact someone else's credit for a personal loan you know you can't repay.

Does a cosigner have to show proof of income?

Is co-signing a bad idea?

Just about the only time getting a cosigner may be considered a bad thing is if you know for sure that you cannot repay the loan you have applied for. The cosigner is fully responsible for the debt as much as the primary borrower is, so if you can't make the payments then the cosigner is legally responsible.When we turn the tables, as a cosigner, you are taking on some risk. Use your best judgment. If the primary applicant defaults on the loan and you will not be able to comfortably cover the monthly payment, you should not co-sign. Keep in mind that when you co-sign for a friend or family member that you may be mixing friendship and financials, which can become complicated,

If you, however, apply for a loan that you are fully committed to and able to repay then the cosigner could be a great boost to your approval chances. Good credit, strong income, and decent financial practices from a cosigner help lenders to feel confident in issuing a personal loan.

Make sure you and your cosigner fully understand the terms of the agreement, including:

- Payment schedules.

- APR percentage.

- Fees.

- Late payment consequences.

- The length of the loan.

- The amount of the personal loan.

- Any other relevant information disclosed to you during the application process.

How much can a cosigner help?

How hard is it to get a loan with a cosigner?

Will a cosigner lower my interest rate?

Where can I get a personal loan with a cosigner?

Closing Thoughts

If your credit history has gone through ups and downs, or perhaps you have no credit at all, a cosigner may help increase your chance of approval. In some cases, you still may not qualify for a loan with a cosigner, but you should definitely have a better chance. At Acorn Finance, you can check personal loan offers with a cosigner. Acorn Finance has trustworthy lending partners that can offer personal loans with APRs as low as 6.99%, depending on your credit score. Individuals can discover simple and competitive payment options through Acorn Finance. At Acorn Finance, you can submit one application and receive loan offers in 60 seconds or less with no impact to your credit score. Once you have claimed the best offer and finalized the loan, you can receive funds quickly.

Do you qualify for a personal loan with a cosigner? Find out today!

$10000 Loan Calculator

Find the loan you're looking for

What can I do with a $10,000 personal loan?

Still have questions?

Why choose Acorn Finance for comparing cosigner loans?

At Acorn Finance, you can check rates with a cosigner. The ability to check rates without impacting credit scores can help you and your cosigner gain confidence that the arrangement makes sense. At Acorn, we partner with top national lenders to streamline the process of comparing personal loan offers. With funding times in as little as 1-2 business days (although funding times can vary) and the ability to check rates in seconds, you can expedite your way to the finish line. Save you and your cosigner time and money but starting the loan shopping process at Acorn Finance.

What are the general rules for a cosigner?

Some lenders allow applicants to apply for a loan with a cosigner. A cosigner can be used to share responsibility for the loan or to increase your chance of approval. Similar to the primary applicant, though, the cosigner needs to meet certain requirements. If the cosigner is a stronger applicant, they may assume the role of the primary applicant: a primary applicant and a cosigner share equal responsibility for the loan. Here are some general rules to consider when choosing a cosigner.

- What is your relationship with the cosigner? A cosigner should be a friend or family member, someone you know and trust. They will need to have tremendous trust in you as well. It’s important to consider the relationship of the cosigner and be honest with them. If you are going to miss a payment or payments, communicate with them. If you default on the loan, both credit scores can be impacted. Cosigning can take a toll on a relationship, so have the hard conversations upfront to lay down the boundaries and learn what’s important to the cosigner and/or how they prefer you to handle certain situations. For example, are they willing and able to cover a payment if you can not?

- Do they have a good credit score? A cosigner should increase your chance of approval and or help you qualify for a competitive offer. If the cosigner has a worse credit score than you, they may still help you qualify, but they may not serve their intended purpose.

- Are they willing to cosign? A cosigner must be willing to cosign. They will need to complete their portion of the application.

How do you protect yourself as a cosigner?

Cosigning on a loan is a big decision. You are equally as responsible for the loan as the primary applicant. To protect yourself, have a conversation prior to cosigning to encourage the applicant to communicate if they are going to miss the payment. Additionally, monitor the loan. Do not cosign and rely on the applicant to handle things. Just as if you were the applicant, ensure monthly payments are made on time. Lastly, use your judgment. Most of us have the desire to help others, but it’s okay to be selfish if you feel it will end poorly.

Can you be denied as a cosigner?

Loan applications can be denied with a cosigner. When applications are declined, usually the whole application (primary applicant and cosigner) is denied. However, applying with a cosigner who doesn’t qualify can impact the loan decision. Some lenders may opt to consult the applicants before denying the loan application. As a co-signer, the loan is reflected on your credit report. Be mindful when cosigning that you are taking on more debt, which can impact your chance of approval for future loans.

What is needed to cosign a loan?

To cosign a loan, you should have a good credit score and meet the requirements set forth by the lender. You may also have to provide supporting documentation such as proof of income and or identification. A cosigner will need to meet the same requirements as the primary applicant, such as having a social security number, qualifying credit score, income, and more.

Will I get approved for a personal loan with a cosigner?

Applying for a personal loan with a cosigner can increase your chance of approval. However, it’s not guaranteed you will qualify. Before applying for a loan with a cosigner, it can be helpful for both parties to check their credit score. You will want to ensure that the cosigning relationship can be beneficial to both parties. Generally, joint loan applications are used by married couples who wish to apply together or applicants who might not qualify on their own. They can also be used to help a bad credit borrower qualify for a more competitive loan.

One home, endless possibilities