Home Improvement Loans in Nevada

Compare monthly payment options from several lenders in under 2 minutes.

How much would you like to finance?

Loans for Home Repair & Home Renovations in Nevada

Find the right home improvement loan in Nevada by using our online tools. When you’re ready to start exploring offers, chooseAcorn Finance. Our lending partners can offer home improvement loans up to $100,000 with competitive APRs. When you check offers at Acorn Finance, you can receive multiple personalized offers with no impact on your credit score.

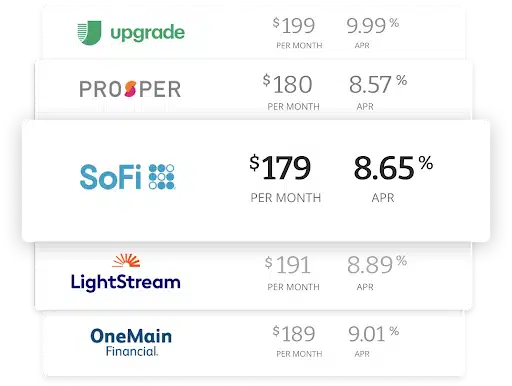

Compare rates from top lenders

Learn More About Home Improvement Loans in Nevada

For many residents of Nevada, getting a home improvement loan makes sense. It's a good way to pay for the home improvements that bring value and comfort now and pay for it later. By shopping lenders and various loans, you should be able to find a loan repayment plan that comes with a comfortable monthly payment that does not stretch the budget too much.

Read more - FAQ

+Can you apply for a home improvement loan in Nevada?

Yes, applying for a home improvement loan is something that homeowners in Nevada do all the time. Additionally, individuals looking to buy an older home in Nevada and then renovate it can do so also with a special kind of home improvement loan. An FHA 203k rehabilitation loan can help someone purchase a home and pay for the costs of renovating it.

Other loan types available in Nevada include home equity loans, home equity lines of credit, cash-out refinance, and personal home improvement loans. Home equity loans, HELOCs, and cash-out refinance loans are tied to the amount of equity in your home, whereas a personal home improvement loan is tied to your personal credit history and income.

Other loan programs may be worth considering include loans through the VA, USDA, Freddie Mac, Fannie Mae, and the Bureau of Indian Affairs.

For basic repairs and improvements, home improvement loans are most common. Since they are not backed by collateral and offer some of the fastest funding times. homeowners appreciate the accessibility of these loans. To check offers, visit Acorn Finance.

How do home improvement loans work in Nevada?

Home improvement loans are simple in concept. A lender agrees to give you the money you need to complete your home renovations and then you pay it back over time with monthly payments. The lender is promised a particular amount of interest as an incentive for providing you with the funds you need. The interest is included in the monthly payments.

Aside from that, the inner workings of each loan type vary. For example, home equity loans and home equity lines of credit are tied to your home's value. The more equity you have in your home, the more you can borrow. Equity is the difference between the fair market value of your home and the remaining balance on your mortgage.

For example, if you have a home that is worth $600,000 and you still owe around $400,000 on the current mortgage, that means you would have $200,000 of equity in your home. With a home equity loan or home equity line of credit, you can borrow sometimes up to 80% or 90% of that equity to pay for home renovations, updates, and other improvements. Fair warning, a home equity loan is a secured loan that uses your house as collateral. If you should happen to be unable to pay your home equity loan, the lender has the right to sell your home to cover the debt.

Benefits of Home Improvement Loans in Nevada:

Homeowners in Nevada often use home improvement loans, and it's easy to understand why when you explore the benefits. While benefits can vary depending on the type of loan and offer, here are some basic benefits.

- Increased value and curb appeal: Building on an addition or finishing a basement are just two examples of how you could use a home improvement loan to increase the value of your home. A new concrete driveway or a large landscaping job could also increase your curb appeal and make your home more desirable to potential buyers.

- Return on investment: Some home improvement projects have a high return on investment. Meaning, that using a loan to pay for particular projects could yield a higher return on investment in the long run.

- Simple monthly payments: Being able to pay back a large sum of money over time with monthly payments is convenient and simple.

- Plenty of options: When it comes to home improvement loans in Nevada, there are plenty of lenders willing to compete for your business. With more options, you can lock in a competitive deal with little effort.

Disadvantages of Home Improvement Loans in Nevada:

Although there are many benefits to taking out a home improvement loan in Nevada, we must also discuss the disadvantages. Here are some of the main disadvantages to obtaining a home improvement loan in Nevada.

- Interest: The main disadvantage to taking out a home improvement loan is the interest that you will need to pay. The longer the repayment period and the higher the interest rate, the more money you will need to pay over time.

- Potential loss of asset: If you take out a home-secured home improvement loan like a home equity loan, HELOC, or cash out refinance, you could potentially lose your home if you are unable to make the payments.

- Damage to credit: Every missed or late payment is a ding on your credit report. Also, when you first take out the loan, you may see a drop in your credit score for the hard inquiry and an increase in overall debt. However, make the payments on time and you can quickly build that score back up.

What are the steps for Nevada home improvement loans?

Before applying for any new line of credit, your first step should be to review your credit report. You can obtain a free credit report online. Check the report to make sure there are no discrepancies and to get a feel of where you stand. Can you identify a few ways that you could quickly boost your credit score? A credit card to pay off or a delinquent account to resolve?

If so, then you may want to consider taking the time. Even a boost of 20 to 30 points can make a big difference in the APRs you will be offered when you begin loan shopping.

Once your credit report is all in order and your score is the highest it can be, then go ahead and go online and prequalify. By doing a soft credit pull, you can notify lenders that you are in the market for a new home improvement loan. You should start to receive loan offers within a few minutes of prequalifying for the loan amount you are looking for.

Take a look at the different offers and choose the loan that makes the most sense to you and your financial needs. Once you find a loan you like, go ahead and complete the loan application process directly with the lender.

To start the prequalification process, visit Acorn Finance. At Acorn Finance you can check offers from a network of trusted lenders with no credit impact.

What can you use a home improvement loan for?

There are plenty of home improvement project ideas that can not only increase the value of your home, but that can also make your home more comfortable for you and your family. For example, you could install a gas fireplace, construct a deck with an outdoor kitchen, build a sunroom or storage shed, or replace all the doors and windows in your home to improve its energy efficiency. If you seek a personal home improvement loan, you are free to use the funds however you would like as long as there are no spending restrictions.

How much can you borrow with a home improvement loan in Nevada?

Loan amounts can vary depending on the type of loan and what you qualify for. If you're using a home equity loan, HELOC, or cash out refinance you can typically borrow anywhere from 80% to 90% of the equity built up in your home. Personal home improvement loans cap out at $100,000, depending on the lender and your credit score. To obtain a $100,000 personal home improvement loan, typically, you will need an excellent credit score and a very high income.

See More Home Improvement Loans by State:

- Home Improvement Loans in Texas

- Home Improvement Loans in Florida

- Home Improvement Loans in Michigan

- Home Improvement Loans in California

- Home Improvement Loans in Georgia

- Home Improvement Loan in Wisconsin

- Home Improvement Loans in Utah

- Home Improvement Loans in Massachusetts

- Home Improvement Loans in Indiana

- Home Improvement Loans in Oklahoma

- Home Improvement Loans in Nevada

- Home Improvement Loans in Louisiana

- Home Improvement Loans in Maine

$10000 Loan Calculator

Find the loan you're looking for

What can I do with a $10,000 personal loan?

Still have questions?

One home, endless possibilities