$500 Personal Loan Options

Compare monthly payment options from several lenders in under 2 minutes.

How much would you like to finance?

Learn How Secure a Personal Loan for $500

A $500 personal loan is considered a very small loan. A personal loan of $500 will be for a borrower with a low credit score. Check offers at Acorn Finance to see if you qualify for $500 personal loans from our lenders.

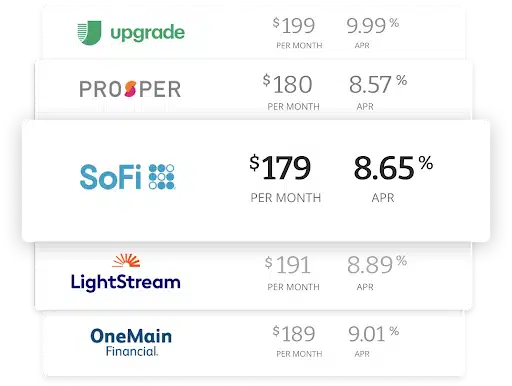

Compare rates from top lenders

Learn More About $500 Personal Loan Options

With a low credit score, you may only qualify for small personal loans. However, depending on your circumstances, it may be difficult to qualify for any kind of loan. Some lenders may be more accommodating for borrowers with bad credit so who you intend to work with will impact the outcome. Keep reading to learn more.

Read more - FAQ

+Can I get a $500 personal loan?

Getting a $500 personal loan can be relatively easy depending on your credit situation. Even if you have bad credit, however, a $500 personal loan is a small enough amount that there are still many options available to you. A $500 personal loan is something that you may need for an unexpected emergency expense like paying a plumber, or maybe you need a little extra to make ends meet at the end of the month. Either way, a $500 personal loan is a perfectly achievable request for borrowers with all different types of credit histories.

How can I get a $500 personal loan?

If you are looking for a $500 personal loan, there are many ways that you can find a loan for this small amount. You could consider asking a close friend or relative for a quick loan. You could see if your bank will give you an advance on a direct deposit. You could visit a pawn shop and get a loan again for some jewelry you own. Or, you could look into online lenders who specialize in short-term small loans. Many online lenders will have minimum loan amount requirements that start at $1,000, but many will make loans in amounts as low as $300. The online lending market may be a great place to start looking if you are looking for a quick and easy loan that requires no collateral and that also contains a reasonable interest rate. Interest rates may be more reasonable when shopping loan offers from online lenders because the online lending market can be fiercely competitive.

How can I get a $500 personal loan fast?

If you are looking for a $500 personal loan, but you need the money immediately, you may want to ask a friend or relative who may be able to withdraw cash for you from their personal bank over their lunch hour. You could also visit a pawn shop that will pay you cash immediately for an item such as a laptop, gold watch, or an antique you have had in your possession.

If neither of those is an option, then you may want to consider an online lender who specializes in same-day personal loans. Many online lenders on the lending market may be able to help you secure a same-day personal loan. If you begin the loan application process early in the morning, are attentive, and respond to any additional requests the lender may have, you could see the fund deposited into your account later that day.

Is it better to get a credit card or a $500 personal loan?

Depending on what the $500 is for, you may benefit from using a personal loan rather than a credit card. A credit card can be convenient, and if you plan on paying off the $500 before the end of the billing cycle when the interest is charged, then it may be the better option. However, if you are going to take a couple of months to pay off the $500, then a personal loan may be the best option if you are looking to pay a lower APR. Credit card APRs tend to be pretty high. Personal loan interest rates can be high as well in some circumstances, but even if you have fair credit, it may be worth your time to consider a personal loan versus using a credit card. It may save you money in the long run by having a definite payoff date and a potentially lower interest rate.

What can I do with my $500 personal loan?

A $500 personal loan may be used for whatever reason you need. You can use it to pay your landlord some back rent, cover some utility bills for the month, or to get a new alternator put into your vehicle. A $500 personal loan could also be used to simply purchase some back to school clothing and supplies for your children as they head back to school for the year. Once the funds are deposited into your account, they are truly yours and you can spend them at your discretion. Most often, you do not need to disclose the purpose of the loan in the loan application process.

How long will it take to pay back a $500 loan?

When you apply for a $500 personal loan, you will need to work with the lender to determine what kind of monthly payments you will need to make and when the loan will be paid in full including interest. The nice thing about a personal loan is that, if you make all your payments on time, you will know exactly when it will be paid off based on the loan repayment period that is predetermined. With a credit card, if you make the minimum payments, the initial amount can take much longer to pay off, costing you more money in interest in the long run.

What credit score is needed to secure a $500 personal loan?

Typically, lenders are going to want to see a credit score of at least 610 to be considered for an unsecured personal loan. Some lenders may have higher requirements and some may have lower. Depending on the lender, you may see some that require a minimum credit score of at least 660 to get your foot in the door, and on the other end, you may find some lenders that go as low as 560. The best way to find out if you can qualify for a $500 personal loan is to complete a pre-approval process. By completing a pre-approval process you will be able to find out if you can qualify for a personal loan based on your credit score. You will also then be able to see which lenders offer personal loans for $500, what interest rates they offer, and what common loan repayment periods are available.

What is the best bank to get a $500 personal loan?

There really is no one best bank to get a $500 personal loan. The best bank to get a personal loan is the one that works best for your individual situation. Online lenders may make an excellent choice for you to explore. The best way to get started is to complete a pre-approval process so you can shop multiple lenders at the same time. By shopping multiple online leaders side-by-side and at the same time, you can ensure you find the best interest rates and the best loan options for your situation.

Where can I get a $500 personal loan online?

Most online lenders have a minimum loan amount of $1,000. However, there are some that can offer a $500 personal loan. One online lender that has a minimum loan amount of $300 is Oportun. In some cases, you may be better off to borrow a little more and expand your options. At Acorn Finance you can check personal loan offers between $1,000 and $100,000.

Closing Thoughts

It may be easier to find a lender that offers $1,000 personal loans compared to $500 personal loans. If you need to borrow $500 you might want to consider using a credit card or asking a friend or family member for a loan. If it makes sense to borrow a little more money, such as $1,000, then it may be easier to find a personal loan. To check personal loan offers between $1,000 and $100,000 visit Acorn Finance. Within 60 seconds or less you can check offers from top national lenders without impacting your credit score.

Explore personal loan offers with no impact on your credit score. . . visit Acorn Finance today!

How can I get a personal loan fast?

Get Started$500 Loan Calculator

Find the loan you're looking for

What can I do with a $500 personal loan?

Still have questions?

One home, endless possibilities