How Many Personal Loans Can You Have at Once?

Compare monthly payment options from several lenders in under 2 minutes.

How much would you like to finance?

So How Many Personal Loans Can You Really Have at One Time?

Consumers can have multiple personal loans and other types of financing at once as long as they can qualify for the lender’s requirements at the time of their loan application.

If you already have one personal loan, you may be wondering if you can qualify for another simultaneously. In some cases, you may be able to have multiple personal loans at once. You may increase your chance of approval by paying down your current personal loan some before applying for another one. Qualifying for a second personal loan is going to be very much the same as when you applied and qualified for your previous personal loan.

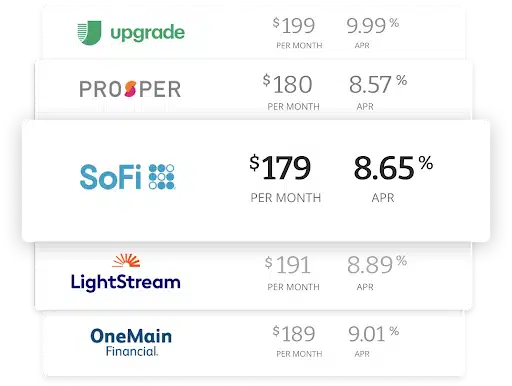

Compare rates from top lenders

How Many Personal Loans Can You Have at Once?

While you can technically have more than one personal loan from the same lender, you may have a much better chance of getting approved for a secondary personal loan from a different bank or credit union than the original loan. Lenders may place limitations on either the number of loans you can have from them or the total amount you can borrow across all loans.

Before taking another personal loan, you should be up to date with payments on your current loan(s). In addition, you should have extra money to cover another monthly payment. While it may be fun to take personal loans and receive lump sums of money, it can be dangerous too. Borrow wisely and always have a plan. Keep reading to learn more about how many personal loans you can have at once.

Can you get multiple personal loans?

You can have multiple personal loans. They can either be by the same lender or you can use several different lenders. There are no laws or rules that say people can only have a certain number of personal loans.

However, lenders and companies may begin to deny you personal loans if they see you have several at once. You may be more likely to get denied if you have defaulted on payments before, have a low credit score, or don't have a source of income.

If you have several different sources of existing debt, you may also be denied. Getting multiple personal loans will depend on the lender you are working with and how much money you need given to you.

Is there a limit on personal loans?

On a federal and state level, there are no laws or legal prohibitions stating a limit on personal loans. Lenders may deny you if you have too much existing debt, a low credit score, or a history of not making payments on time.

How many loans can you apply for at once?

Some lenders will only let you apply for one loan at a time. If you are shopping around for loans and best interest rates, you can apply for them all at once if they are from different companies. If you are interested in receiving multiple personal loan offers at once, you can check offers at Acorn Finance without impacting your credit score.

How long should you wait before applying for another loan?

If you want to use the same lender, you might need to wait a specified time as outlined in your loan agreement. In general, most lenders and financial professionals recommend people to wait 6 months between loan applications. This will allow your credit score to bounce back up. It will also give you some more time to make payments on existing loans and hopefully lower your debt-to-income ratio. This should improve your approval odds when applying for another loan.

Since applying for a new loan and opening a new account can result in a slight hit to your credit score, you may want to wait at least 6 months before applying for a second personal loan. This can help ensure that your credit score has had time to recover and that you can qualify for the best possible interest rate. Some lenders actually impose a timeline on when their customers can apply for a second loan. For example, the online lender SoFi requires a minimum of 3 monthly payments made towards an existing loan before consumers can apply again. Waiting will allow your credit score time to recover and help ensure that you get the best possible interest rate on your loan application.

Do multiple loans affect credit score?

Having multiple loans can affect your credit score, especially if you begin to have trouble keeping up with the monthly payments

There are a few factors that go into calculating your credit score. Some of these include account diversity, number of open accounts, and the length of your overall credit history. Taking out more than one personal loan increases your number of open accounts and could cause your score to temporarily drop. In addition, applying for loans results in a hard inquiry to your credit report which can negatively affect your credit score for a short time after application.

Risks of opening multiple personal loans:

On the other hand, the potential risks of opening multiple personal loans are many.

You may experience a more significant drop in your credit score by opening up multiple personal loans, especially if they are opened up back to back.

You may have trouble paying back the loans and keeping up with your new monthly budget.

The most worrisome risk is that of defaulting on one or both of the loans or failing to keep up with the minimum payments. In the event that you fail to repay the loans, or you begin racking up a series of late or missed payments, you will receive derogatory marks and even collections activity that can remain on your credit report for up to 7 years.

When is it a good idea to open multiple personal loans?

There are a few times when it could be a good idea to open multiple personal loans.

If you have proven to be responsible with your first personal loan, and especially if you are nearing the very end of your original loan term, it shouldn't hurt to take on another personal loan if you need one for a particular expense. For example, if you are in need of an unexpected car repair and need quick access to $3,000 in order to pay for it, taking out a personal loan is often the wisest financial choice to make – even if you already have an existing loan.

Personal loans typically have lower interest rates than credit cards and it can be much easier to manage the repayment of personal loans over credit cards. This is because personal loans have a fixed monthly payment and consumers cannot keep charging purchases and racking up more debt like with a credit card.

It can also be a good idea to open a second personal loan if you have multiple loans and lines of credit that you need to pay off by consolidating them into one management monthly payment with a new loan. We will cover debt consolidation in more detail later in this article.

How can you boost your chances of getting approved for a second loan?

Improving your credit score should always help your chances of getting approved for any type of loan, especially if you are applying for a second personal loan in a short period of time.

If you are considering applying for a new loan, take some steps to increase your credit score such as paying down debt to reduce your credit utilization, disputing any old or inaccurate information, requesting the courtesy removal of any late or missed payments, and even requesting credit limit increases on your credit cards to improve your utilization ratio.

Lenders can also look at your current income and debt-to-income ratio, so anything that you can do to improve your income and reduce your debt should help your chances of approval.

$10000 Loan Calculator

Find the loan you're looking for

What can I do with a $10,000 personal loan?

Still have questions?

Learn More About Having Multiple Personal Loans At One:

Is it bad to apply for multiple loans?

Checking to see if you pre qualify for loans is a good way to check interest rates and terms before applying for multiple loans. The prequalification process is also usually an application that results in a soft pull of your credit. Sending in official loan applications can hurt your credit score. If you apply for multiple loans that require a hard credit pull, this will likely affect your credit score.

Can I get a personal loan to pay off another personal loan?

Most lenders don't check what you are using a personal loan for, so you can take a personal loan to pay another personal loan. If you are doing this though, make sure the new personal loan has a lower interest rate and lower monthly payments to give you an advantage over the old personal loan.

Personal loans can be used for a variety of things from car expenses, medical costs, or debt consolidation. Make sure you check the terms of any loan you decide to take to ensure there are no regulations about what to use the money for. If there are, check the deposit rules as some of these companies pay your other loan company directly rather than you.

Sometimes you can also refinance a personal loan with a second personal loan with the same company. You can also use a second lender for this. If you are using a lender that checks what you are using the loan for, they may set up the direct payment to cover the existing loan. Other lenders may directly give you the loan amount and then you pay it to the other lender for your previous loan.

Since the funds from personal loans are not regulated as with other types of financing like a home mortgage, you can technically use the cash you receive from a personal loan for any purpose including paying off another loan. In fact, some personal loans are specifically marketed as debt consolidation loans with the purpose of helping consumers pay off their debts, although these are typically geared towards paying off credit cards. Since personal loans can have loan amounts of up to $100,000, they can be a convenient way to pay off 1 or more smaller loans and convert your debt into a smaller and more manageable monthly payment.

How many personal loans can you have at once from one lender?

While you can theoretically have more than 1 personal loan from the same lender, it may be difficult to find a lender who is willing to approve you for more than 1 loan at the same time.

In addition, lenders may limit borrowers from exceeding a certain amount of funds across all loans taken out through them. For example, the online lender SoFi limits borrowers to a maximum of $100,000 in financing from all loan products and 2 total loans out at once.

Can you have 3 personal loans at once?

This depends on the lender you are working with. Some companies have a limit of one or two loans that they are willing to give to the same person. They may also have maximum loan amounts. So, even if they offer several loans at the same time, you might not be able to take out another one if you have already reached the maximum amount.

Companies may also require you to make a certain amount of payments on time before they will let you apply for another loan. There might also be a waiting period of 60 days or more before you can apply for another loan.

Can I take two personal loans at a time from different bank?

Technically, there is nothing that should get in the way of consumers having 2 personal loans at a time from 2 different banks. When you apply for your second personal loan, the lender can evaluate your personal financial situation and creditworthiness just as when you applied for the first loan. As long as you otherwise qualify for the loan based on your income, credit score, and other factors, having a personal loan taken out from another lender should not disqualify you.

The situation where having a personal loan could affect you from getting another one is if the lender calculates your debt-to-income ratio (DTI) and finds that it is too high for you to be able to reasonably afford to pay back the borrowed funds.

What are the personal loan requirements?

Personal loan requirements can vary from lender to lender, but generally will include a minimum allowable credit score and some form of income requirement. Some online lenders do not require a minimum income, and other banks and credit unions may be willing to work with low or no income borrowers as well.

You may need to submit accurate documentation proving your identity, income, employment, and possible other financial information. Typically, lenders also require that applicants are at least 18 years of age with a valid social security number and a bank account.

In the event that applicants fail to meet any or all of the loan qualifications, some lenders will allow you to apply for your loan using a cosigner who can take on the liability of repayment. When you apply using a cosigner, their credit score, income, and other financial information is used in the loan decision process instead of the original applicant's information.

How much of a personal loan can I get?

Personal loan amounts vary from $1,000 all the way up to an impressive $100,000 depending on the lender. How much money you can expect to receive will also depend on whether or not you meet the lender's qualifications. If you do not have a top-notch credit score or high income, you should not expect to be approved for the maximum loan amount of $100,000.

For example, the popular online lender LightStream offers personal loans of amounts ranging from $5,000 to $100,000, but borrowers must have a credit score of at least 660 and a minimum annual income of at least $50,000 in order to qualify for a loan of any amount.

However, as previously mentioned, a cosigner can be used in these cases to help borrowers qualify for more than they would have been able to get on their own.

What should you watch out for when applying for multiple personal loans?

There are a number of things you should look out for when you are trying to obtain more than one personal loan.

Make sure that you are not falling victim to predatory practices or settling for unsatisfactory terms when applying for your secondary personal loan. Oftentimes, the desperation of trying to find a new loan can cause consumers to agree to terms that are not at all beneficial, such as extremely high interest rates or fees. Always take your time and be sure to conduct research as well as perform a thorough comparison between different lenders to make sure you are not getting scammed or taken advantage of. Lastly, watch out for brokerage websites that make promises of approving you for financing but fail to deliver. Many of these websites instead sell your information to various other lending companies who then harass you with phone calls.

Can multiple personal loans make sense?

In some cases, it can make sense to have multiple personal loans at one time. There are times when you may need to fund another major expense or purchase shortly after financing the first one. For example, one year you may need to finance a wedding and the next year while you are still paying off the first loan, you may encounter the need to make some home improvements. There are many times when consumers can benefit from the ability to have multiple personal loans, which is why so many lenders do try to allow them.

Do multiple loan applications hurt your credit?

If the loan application requires a hard pull of your credit, then it can damage your score. Some lenders start with a soft pull of your credit to see if you pre qualify for the loan. This will not hurt your credit score. If you decide to go forward with the application, the lender may do a hard pull and drop the score by a few points.

Try to only apply for loans that you are pre-qualified for and intend to move forward with. You should also wait for a loan application to be rejected or accepted before applying for another loan.

How many hard inquiries is too many?

In terms of credit score, 6 or more hard inquiries is enough to significantly drop your score and damage it for months to come. The more hard inquiries on a report also have been linked to higher incidents of bankruptcies.

Try not to apply for too many loans at once. Using Acorn Finance, you can see which loans you pre qualify for to give you a better idea of the options available to you. So, when you apply for loans, you would know you have a better chance of receiving the funding if the lender gave you prequalification status. Checking offers at Acorn Finance does not impact your credit score.

Do multiple hard inquiries hurt your credit?

Several hard inquiries done in a short period of time can drop your credit score by a few points each. Even a few points can make a large dent, so hard inquiries can damage your credit score for a few months or longer.

Remember that hard inquiries happen even if the loan application is not approved. It's better to apply for loans that you are prequalified for or have a better chance of receiving. This way you won't need to apply for several different loans.

Personal loans can be a way for you to pay off expenses or other loans that you may be struggling with. It's important to check for low interest rates and low minimum payments so that the loan doesn't become a burden. Check multiple offers before deciding on which ones to submit official applications for.

Acorn Finance has trustworthy lending partners that can offer personal loans with APRs as low as 6.99% depending on your credit score. Individuals can discover simple and competitive payment options through Acorn Finance. At Acorn Finance, you can submit one application and receive loan offers in 60 seconds or less with no impact to your credit score. Once you have claimed the best offer and finalized the loan, you can receive funds quickly.

Can I get a personal loan if I already have one?

The short answer is that you should be able to get a second personal loan even if you already have an existing one. However, it may be difficult to find a lender who is willing to extend a loan offer to you if your debt-to-income ratio is very high or if your credit score is too low.

In addition, you will need to make sure you can responsibly pay back your debts before you even consider applying for a second or a third personal loan. Accumulating too much debt can make it difficult, if not impossible, to keep up with all of your financial obligations and stick to a budget. Since keeping up with your minimum monthly payments is critical to improving and maintaining your credit score, it may not be a smart idea to accumulate multiple loans.

One home, endless possibilities