Installment Loans for Bad Credit

Compare monthly payment options from several lenders in under 2 minutes.

How much would you like to finance?

Get Guaranteed Installment Loans for Bad Credit Today

Installment loans, or personal loans as they usually are called, are one of the most common ways to borrow money. Installment loans for bad credit are available through several lenders. To find out if you qualify, start by applying or checking offers.

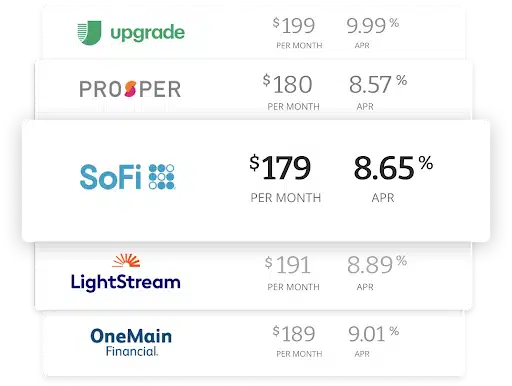

Compare rates from top lenders

Learn More About Installment Loans for Bad Credit

Finding a guaranteed installment loan for bad credit may be difficult. If you are unfamiliar with your credit score, you should start by checking your credit report. Once you know what your credit score is you can find a lender that can help. There are times when you might need to borrow money. For example, you may have a major repair, medical bills, a special event like a wedding, home improvements, or a trip you need to take. Borrowers have a lot of options when it comes to borrowing. Some common ways to borrow are a line of credit, a credit card, a home equity line of credit, a cash-out refinance, or an installment loan.

What credit score do you need to get an installment loan?

While it can vary by lender, your credit score usually needs to be above 600 or higher to secure an installment loan from an Acorn Finance partner. However, there are some lenders that specifically cater to those with very bad credit. If you are unable to qualify for an installment loan, you can look into getting a cosigner or see how you can work to improve your credit score to increase your approval chances. You can also consider taking steps to boost your credit score. Whatever decision you choose to make, just be sure to think it through clearly.

Do installment loans require a credit check?

Yes, most installment loans require a credit check. While you can check offers at Acorn Finance with no credit impact, you will need to consent to a hard credit pull before the loan is funded.

Is getting an installment loan worth it?

If you are considering getting a personal installment loan for bad credit, it’s important to consider the level of need. With bad credit, adding additional debt in the form of a personal installment loan can be risky unless you are in desperate need of immediate funds and feel confident you’re able to repay the outlined amount monthly.

However, they can also be a way to build your credit score and show lenders you’re responsible with money. With regular on-time payments and responsible borrowing, you can improve your credit score with a personal installment loan for bad credit. Ultimately, each borrower will need to decide if getting an installment loan is worth it.

$[acf field ="loan_amount"] Personal Loan

Find the loan you're looking for

What can I do with a $1,000 personal loan?

Still have questions?

Where can I get an installment loan with bad credit?

Borrowers with bad credit may have a higher chance of approval finding an installment loan online. As with any online activity though, you’ll want to take certain precautions. One way to ensure you are working with legitimate lenders is to utilize our platform to check offers. Bad credit can often lead to desperation, especially when you need to borrow money. As you shop installment loan offers, be realistic and patient. If possible, consider investing time into boosting your credit score before taking out a loan as this will expand your options. At Acorn Finance most of our lending partners have a credit score cutoff of 600 or above.

When the need to borrow money arises, bad credit can certainly stand in your way. For good and bad credit borrowers, installment loans are often used, especially when funds are needed quickly. Installment loans are generally funded as a lump sum and repaid in installments - hence the name. Personal loans are an example of an installment loan. So, what credit score do you need to qualify for an installment loan? Where do you go to find out if you qualify?

If you’re looking for an installment loan and have bad credit, you can check offers at Acorn Finance with no credit impact. Read on as we provide valuable insight on installment loans for bad credit.

What is the best example of an installment loan?

A personal loan is usually the most common type of installment loan, with the borrower receiving a lump sum of money and repaying monthly over a fixed period of time. Some other common forms of installment loans include auto loans, mortgages, student loans and buy-now, pay-later loans. These all have a fixed payment schedule that provides a lump sum to the borrower.

Can you use an installment loan for anything?

There are countless ways you can use an installment loan. From consolidating debt to renovating your house, there are hardly any requirements on how you can use an installment loan. Check with the lender of your choice for specifics on spending restrictions to determine what your loan can and cannot be used for.

Is an installment loan better than a payday loan?

While both of these lending products offer fast and short-term loan options for borrowers, they are not exactly the same. While both payday loans and personal installment loans can help people with poor credit get funds, payday loans usually are much more expensive and make it difficult for borrowers to repay — sometimes up to 400% in borrowing costs.

On the other hand, installment loans have a fixed payment amount that is paid over several months instead of taking a portion of your next paycheck. Payday loans are also usually capped at $500, minimizing their overall use.

What is an unsecured installment loan?

An unsecured installment loan does not require any collateral to secure the loan, meaning that you won’t have to put any down payment or other collateral as leverage to get the loan. Instead, the lender makes an application decision based on the borrower's creditworthiness and ability to repay the loan based on their credit history, income, and other factors.

For borrowers with poor credit who don’t have other collateral to place down for the loan, an unsecured personal loan can help you get the funds you need without collateral.

Getting an installment loan with bad credit may require some extra effort, but it can be a valuable tool for improving your financial situation. Plus, if you repay the loan on-time it can work to benefit your credit score. Nevertheless borrowing money does cost money and the more risk you pose to a lender, the higher those costs can be. Compare offers closely and make smart financial decisions. When you’re ready, visit Acorn Finance to check installment loan offers with no credit impact.

What is the easiest loan to get with bad credit?

If you have bad credit and you need money, you may be wondering what kind of options you have available to you. If you have the time to work on your credit score before taking on a new line of credit, it may be in your best interest to do so. However, if you need money immediately and you have bad credit, there are still many types of financing options that you can explore. Some of these options may be expensive in terms of interest rates and fees, and they could present some additional risks to your already fragile credit, that is why the decision to take on a bad credit loan should not be taken lightly. Here is a list of some of the most common bad credit loan options that some borrowers consider when looking for a quick cash infusion.

Emergency loans: Some lenders have emergency loans that come with smaller loan amounts, shorter repayment periods, and higher interest rates. These loans are typically for as little as $1,000 or as much as $5,000. The good news is that there are plenty of lenders that can put the money into your account either the same or the next day after you sign the loan agreement. If you have a bad credit score, be careful because these loans can come with APRs as high as 36% along with origination fees that can sometimes reach 10%.

No credit-check loans: No credit check loans are an option for bad credit borrowers who may have a credit score lower than 560 or that may have too much-existing debt to qualify for a personal loan without a cosigner or without using collateral No credit-check loans come with higher interest rates of up to 36$ plus other fees.

Payday loans: Payday loans are short-term loans that need to be paid back from your next paycheck. You are essentially going through a 3rd party to receive an advance on your upcoming paycheck. Payday loan centers typically do not need to check your credit score but they may ask for your most recent pay stubs to see how much you can borrow. A payday loan should only be used when you have exhausted all other options due to the fact that they come with incredibly high-interest rates and fees. Some payday loan lenders can charge APRs as high as 400 percent. If for any reason you cannot pay off the loan by the due date, you may be offered a new loan to cover the original loan and its fees, but be careful. This is what is known as the payday loan debt spiral which you could become trapped in for weeks or even months.

Title loans: Title loans are typically offered through a title loan center that will give you a loan for usually 30-days that you secure with the title for your personal vehicle. Title loans also come with incredibly high-interest rates, and even more daunting, if you are unable to pay your loan balance plus interest and fees by the due date, the company may repossess your vehicle and sell it to cover the loan balance. If they do not repossess your car, they too may offer another 30-day loan to cover the original loan amount plus fees. This is another debt spiral that you should avoid.

Pawnshop loan: If you have something valuable like a musical instrument, rare coins, gold, silver, collectibles, and/or antiques, you could always use them as collateral to obtain a loan at a pawn shop, or if you would like, you could consider selling them outright. If you take the loan, you risk losing the item you used as collateral to secure the loan if you are unable to pay back the loan.

Friends or family loan: If you have bad credit, then the cheapest option for a personal loan is to ask a friend or family member for a small loan to get you through a rough patch. Most likely a friend or family member may not expect interest in return but make sure you pay them back as soon as possible. Money issues can sometimes put a strain on personal relationships if debts are not paid. Also, once you are financially stable and you pay back the loan, it may not be a bad gesture to take them out to dinner or to a special event.

401k loan: If you have a 401k retirement account that you pay into, you can always explore loan or hardship distribution options based on your circumstances. If you take out a loan from your 401k, any interest that you pay goes back into your retirement account. It is important to also note that if you are unable to pay back the loan, there are early withdrawal penalties as well as tax implications to consider.

Paycheck advance: Depending on who your employer is, you may be able to contact your employer or your HR department to see if there is a way you can get an advance on your upcoming paycheck(s).

Payment plans: Depending on who the creditor is you may be able to reach out to them directly to inform them that you cannot pay them in full at the time and that you would like to explore payment plan options. You may be able to do payment plans with your dental office, doctor's office, hospital, phone company, or any of your utility providers.

A local bank or credit union: If you have a long history with your personal bank or credit union, they may be able to offer you an installment loan for a small amount if you have direct deposit set up for your payroll checks. Some banks or credit unions may be able to work with someone who has multiple accounts and many years has been a loyal customer at the bank or credit union.

Personal loan: Personal loans are a type of installment loan that you may qualify for if you have bad credit. In some cases, lenders allow joint applications for personal loans. If you have bad credit but can apply with a co-applicant that has better credit than you, your chance of qualifying may increase.

Personal loans are a top choice for bad credit borrowers that need an installment loan. In most cases they can be secured with no collateral and funded quickly. One lender that offers personal loans for borrowers with credit scores as low as 560 is Upgrade. If you are unable to qualify for an unsecured personal loan you may need to consider a secured loan option such as a secured personal loan or secured credit card. Alternatively you may be able to apply with a co-signer.

If you opt to use a co-signer on the loan, if you should happen to fall behind on payments, the co-signer most likely will be asked to cover the loan payments. If they cannot afford the payments, then both you and the co-signer could see some negative impact on your credit scores. Using a co-signer is similar to using a friend or family loan. Although your friend or family members are not giving you the money directly, their credit could be harmed if you are unable to hold up to your end of the bargain. These types of situations tend to put unwanted stresses on your personal relationships, so if you decide to go with a co-signer, you should be absolutely sure you can afford the monthly payments.

What credit score do you need for an installment loan?

Credit score requirements for installment loans can vary depending on the lender. Most lenders make their minimum credit score requirements available online and some lenders may have no minimum credit score requirement. It's recommended that you should have a score 600 or above, although some lenders may be able to help borrowers with scores below 600. A bad credit borrower is anyone who has a credit score below 630. Having a bad credit score under 630 is not ideal, however, it is not the end of the world. There are still plenty of lenders who offer installment loans to borrowers with credit scores under 630. Here is a quick list of some of the lenders who specialize in installment loans for bad credit borrowers and their minimum requirements for qualification.

- Best Egg: Minimum credit score of 600 for installment loan amounts between $2,000 and $50,000.

- Prosper: Minimum credit score of 600 for installment loan amounts between $2,000 and $40,000.

- Upgrade: Minimum credit score of 560 for installment loan amounts between $1,000 and $50,000.

- OneMain Financial: Minimum credit score of 600 with a minimum income requirement of $7,200 for installment loan amounts between $1,500 and $20,000.

- LendingPoint: Minimum credit score of 600 with a minimum income requirement of $30,000 for installment loan amounts between $2,000 and $25,000.

Keep in mind that if you do not have a credit score that meets the lender's minimum requirements, you may still have a few options to explore. For example, some lenders may allow you to add a co-borrower or co-signer to the loan. A co-borrower is like a co-signer except they will have access to the funds as well. Either way, a co-borrower or cosigner with good or excellent credit can go a long way to helping someone with bad credit qualify for an installment loan. If you have a bad credit score but you are within a few points of a lender's minimum credit score requirements, you may want to try to prequalify or reach out to the lender directly to see if there is even the slightest chance that you may be approved.

Lenders do not only consider credit scores, they consider income, existing debts, and sometimes they may even look at credit history and recognize that maybe you had some financial difficulties a few years back that has dragged down your credit score but now you have a couple of years of perfect payment history. You may never know if you do not ask.

Another option to consider if you have a lower credit score that is below the minimum credit score requirements of a typical lender is to find a lender who offers a secured installment loan option. By using your home, vehicle, or another asset as collateral, you may be able to find a lender who will extend to you an installment loan even though your credit score is below their minimum requirements. Also, there is always the no-credit-check installment loan that could also be considered.

So what exactly is an installment loan?

Installment loans are a type of loan that allows someone to borrow a set amount of money and pay it back with a certain number of installments over a fixed period of time. Some installment loans can involve monthly installments while others may require bi-weekly or even weekly installments. The number of installments needed to pay back the loan amount and the payment schedule are determined by the loan amount and the preferences of the lender. Installment loans are sometimes their own distinct version of a personal loan, however, auto loans and mortgages could also be considered types of installment loans. They do fit the definition. Car loans and mortgages are technically fixed-rate loans that are paid back through fixed and equal monthly installments.

One of the main benefits of an installment loan is that the payments are predictable and unchanging. This can help someone who may have less than perfect credit and a strict monthly budget calculate how much they can actually afford when looking at their installment loan options. Before you sign an installment loan agreement, you should already know exactly how much your installment payments will be and how frequently you will need to pay them. This can help you to budget for your loan payment(s) each month as well as help to prevent you from missing any payments. You may also want to consider signing up for autopay to help guarantee that no payment will go unpaid.

Another benefit of an installment loan is that you will know exactly when the debt will be paid in full. If you make every installment payment on time, then you should have a definitive pay-off date as well as know exactly how much interest you will be charged. Late or missed payments may incur fees and push your anticipated pay-off date back.

Can you get an installment loan with a 550 credit score?

Yes, although it may be more difficult to obtain an installment loan with a 550 credit score, there may be some lenders who would still consider you if you had a large monthly income and very little existing debts. However, if your 550 credit score is the direct result of a recent bankruptcy filing, then you may find it even harder to qualify for an installment loan with that 550 credit score. Your best chances of qualifying for an installment loan with a 550 credit score is by using a co-borrower or co-signer, or by using an asset such as your home or vehicle to secure the loan.

Can you get an installment loan with a 500 credit score?

If you have a credit score as low as 500, there really is no sugar-coating it, you may be in a really bad position if you are looking for any type of a new line of credit. So, exactly how bad is a credit score of 500? A credit score of 500 is considered a very poor credit score in the bottom 10th percentile of all credit scores. A very poor credit score is any credit score below 579, of which 16% of all consumers have a score in this range. Even fewer have a credit score of 500 or below. That being said, it is estimated that about 62% of consumers in the very poor credit range are likely to fall behind on loan payments for more than 90-days. Additionally, around 19% of all consumers with a 500 credit score have been past due on credit accounts for 30-days or more within the last 10-days. It is statistics like these that scare lenders when it comes to providing installment loans to borrowers with credit scores of 500. A few other statistics that lenders may be wary of is the fact that the average credit card debt among consumers with a credit score of 500 is about $2,734 with an average credit utilization ratio of 113.1%. A 113.1% credit utilization ratio means that the average borrower with a 500 credit score has more debt than authorized credit.

If you are a borrower with a credit score of 500, you should seriously consider working on your credit before attempting to apply for an installment loan. If need be, you may be able to find a non-profit that can provide you with debt counseling and help you repair your credit score. If neither of these options is possible, then you may have to consider a no credit check installment loan, payday loan, title loan, or visiting a local pawn shop.

Can you get an installment loan with bad credit?

Yes, the online lending market is filled with lenders that provide installment loans to people with bad credit. Minimum credit scores requirements typically range around 600, however, some lenders may consider borrowers with credit scores as low as 560. There is also the option of a no credit check installment loan, but keep in mind interest rates and fees may be incredibly high.

What are the best bad credit installment loans?

Two of the best bad credit installment loan lenders are Upgrade and LendingPoint. Upgrade only requires a minimum credit score of 560 and they allow for joint applications as well as provide secured loan options to help borrowers with bad credit qualify. LendingPoint only has a minimum credit score requirement of 600 and they offer small loan amounts for bad credit borrowers looking to cover some short-term emergency expenses. Here is a breakdown of these two bad credit lenders in more detail.

What are online installment loans?

Online installment loans are personal loans provided by online lenders through the online lending marketplace. Online lenders tend to have lower minimum credit score requirements for qualifying and they are known for providing money fast to people in need.

Do installment loans check credit?

Most lenders may check your credit when you are applying for an installment loan, however, some lenders may have a no credit check loan option that comes with a higher APR and more fees.

Are installment loans risky?

Yes, there is always risk involved with installment loans for both the borrower and the lender. However, an installment loan through an online lender may be far less risky than an installment loan through a payday lender or title loan center.

What are installment loans?

A personal installment loan generally can be between $1,000 and $100,000. Installment loans are usually unsecured. The lender has not taken any collateral or assets from the borrower to secure the loan. People typically take between one and twelve years to repay them. The rate of interest is fixed for the term of the loan in most cases. So, what makes them installment loans? They are called installment loans because they are repaid in equal payments over the term of the loan. The lender advances the funds to the borrower, and the borrower repays the loan with equal monthly payments.

Other types of installment loans are mortgages and vehicle loans. You will make fixed payments, and eventually, the loan will be paid off.

Installment loans have advantages and disadvantages. The fixed payments can make it easier to manage and budget for. These loans have an end in sight, so eventually, they will be paid off. Some types of credit, like credit cards and lines of credit, often keep people in a debt cycle because people can keep accessing the credit limit. Having an installment loan can help boost your credit rating. Once you have had it open for a while and make regular payments on time, your credit rating could increase somewhat.

Some borrowers don't like getting the money in one lump sum because they can't re-access the limit. If they need more money, they need to go through the borrowing process again and either increase their loan amount or get another loan. The fixed payments can be hard for some people to manage as well. If you miss payments or make partial payments, you could damage your credit rating too.

Where can I get an installment loan with bad credit?

Some lenders will provide installment loans for bad credit. Some banks and credit unions can approve loans for customers or members with bad credit. One of the more common ways is to apply for installment loans with bad credit is online. Online lenders usually have less strict requirements compared to traditional banks and credit unions. Some online lenders can consider borrowers with lower credit scores. Some lenders that have minimum credit scores as low as 560 are LendingPoint, Upstart, Upgrade, and Universal. Other lenders like OneMain and Oportun don't have a minimum credit score.

If you have bad credit and need an installment loan, it is important that you research companies before accepting loans. You will want to make sure they have reasonable rates, fees and are legitimate lenders.

What credit score do you need to get an installment loan?

The credit score you need to get an installment will vary depending on the lender. For example, Axos has a minimum credit score of 740. The minimum credit score for Lightstream and Marcus is 660. Avant has a minimum credit score of 550. Some lenders that we already looked at, like OneMain, do not have a minimum credit score.

The best thing to do is check your credit score before you apply. You can use this as a starting point to see which lenders would be the best to work with, considering the credit score you have.

Are there no-credit-check installment loans?

It is possible to get a no-credit-check loan, but it's not a good idea in most cases. The lender does not check your credit before approving the loan and advancing funds. Without a credit check, the lender doesn't know if you pay your debts back on time or not. To compensate themselves for this risk, they can charge very high interest rates-sometimes over 400% APR. Not only does this make borrowing extremely expensive, but it can also trap the borrower into a never-ending debt cycle.

How are installment loans different from payday loans?

Installment loans are larger amounts, are repaid over many months or years with scheduled payments, and the interest rate doesn't usually exceed 35.99%.

Payday loans typically don't exceed a few hundred dollars. The payday lender expects the loan plus interest and fees to be repaid within a couple of weeks. However, interest rates on payday loans can easily exceed three digits-some are as high as 400% APR.

Which loan company is best for bad credit?

It depends on what you are looking for. Some companies will fund loans quickly, others don't have a minimum credit score, and others don't charge origination fees. Some highly rated companies for borrowers with bad credit are Upstart, Lendingclub, Avant, and Upgrade.

How can I get an installment loan with terrible credit?

Getting an installment loan when you have terrible credit can be difficult. Knowing your credit score should help you look for lenders that can be willing to work with you. If you can't qualify for a loan on your own, there are some things you might be able to do to help you qualify. If you can secure the loan with an asset, the lender may approve your request. Adding a cosigner can help, too, since the lender will have another borrower to make loan payments if necessary. Getting someone to guarantee the loan can also help. Many lenders will approve guaranteed installment loans for bad credit.

What is the easiest loan to get approved for?

Secured loans are typically the easiest to qualify for. Securing the loan with an asset like cash in an account or a vehicle reduces the lender's risk, making them far more likely to approve the loan. If the borrower doesn't make their payments, the lender will eventually take the asset to settle the debt. This gives borrowers' an added incentive to make their payments. Borrowers don't want to lose their collateral, especially if they need something like their vehicle. In cases like this, borrowers will often be very diligent about making their payments. Lenders know this and so will approve secured loans more easily than unsecured ones.

How can an installment loan help my credit?

Installment loans should be reported on your credit report. Opening a loan can initially drag down your credit score if the lender made a hard inquiry and if the loan is new. The way to use a loan to help your credit rating is to make all your payments in full and on time. Late or missed payments will have the most damaging effect on your credit rating, so it is important not to have any. As you pay down the loan, the amount you owe compared to what you borrowed will decline, which will positively affect your credit rating. Remember that it can take several months of paying your loan on time before you see your credit score increase, so it is essential to be patient with the process.

Compare installment loan offers with no impact on your credit score. . . get started now!

One home, endless possibilities