Online Payday Loans Near Me For Good & Bad Credit

Compare monthly payment options for alternatives to payday loans from several lenders in under 2 minutes.

How much would you like to finance?

Fast Payday Loans No Credit Check - Alternatives

If you’re like most people, you probably don’t have enough money saved up to cover a major financial emergency. This can leave you in a tough spot when an unexpected expense comes up and you need cash fast.

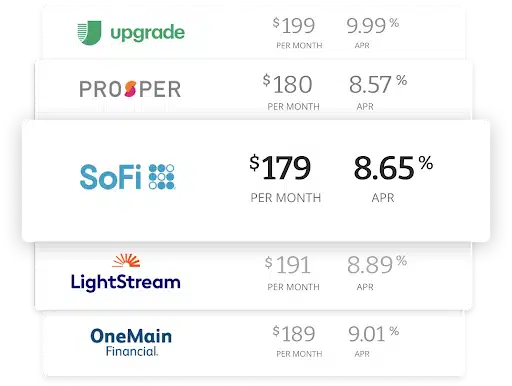

Compare rates from top lenders

Learn More About Payday Loan Alternatives

A payday loan may be your only option in your situation, but before you resort to this high-interest form of borrowing, consider some of the best alternatives to payday loans.

Read more - FAQ

+What can I do instead of a payday loan?

Getting the cash you need – right when you need it – can be a challenge in the best of times. When times are tough, a payday loan might seem like your only option, but it's not. In fact, it's very rarely a good idea to turn to one of these loans.

Fortunately, you have other options. Depending on what you need the money for, you might want to consider turning to local funding sources, like nonprofits or community centers. These places often donate things like clothing, food, and even bus tickets to help you get to job interviews or doctors' appointments.

On that note, if medical issues happen to be what's causing you financial stress, you may want to consider applying for medical bill assistance. From payment plans to medical bill advocates, there are lots of options to turn to.

If these aren't options,. consider bad-credit loans or credit union loans. Often, you don't have to have a high credit score and many lenders offer fast funding with money in just a day or two.

If you have a few days to spare, a personal loan is probably your best option. You can secure a personal loan online and they can be funded within 1-2 business days. Most lenders offer personal loans between $1,000 all the way up to $100,000. Personal loans usually have lower interest rates than payday loans, credit cards, and other options. In addition, they typically offer fixed monthly payments.

If you do not qualify for any of the above options, you can reach out to a trusted family member or friend and ask for a loan. Although these methods all have their own pros and cons, they're all better solutions than payday loans, in most cases.

What are 4 reasons to avoid payday loans?

While payday loans might have their place in some situations, they are very rarely a good idea for most borrowers. Here are 4 reasons to avoid payday loans.

- Expensive. Payday loans are extremely expensive. You might pay more than double the interest that you'd be charged on even a high-interest credit card. Usually, these interest rates kick in within two weeks of taking out the loan – and within those two weeks, most borrowers are unable to pay back the loan, meaning the interest rates will soon have them in financial quicksand.

- May lead to a debt cycle. Payday loans offer fast cash for an expensive price. Therefore, they will cost you more than if you saved the money and avoided a loan all together. The ability to access fast cash through payday loans can lead to a consistent cycle of debt.

- Fees. In addition to high interest rates, payday loans often come with extremely high fees. Especially, if you fail to repay a payday loan.

- Payday loans often require access to your bank account. Borrowing from a payday loan doesn't require extensive paperwork – something that's attractive to many borrowers. However, this is also dangerous, because you might wind up giving a lender access to your bank account. These lenders tend to be aggressive debt collectors who will stop at nothing to get their money back. Of course, payday loans can completely annihilate your credit.

What are some alternative methods to a cash advance?

Rather than a cash advance, or payday loan, consider the following alternatives:

- A loan from a friend or family member

- A peer-to-peer loan

- Personal loans

- Donations from local charities

- Low interest or 0% APR credit cards

- Loans from local banks or credit unions

Are installment loans better than payday loans?

In most cases, yes. Most installment loans are personal loans, which typically have interest rates no higher than 20-36%. Although this is still a high rate, you likely won't pay rates that high, and the interest rates for these installment loans is still much lower than what you'd be charged for a payday loan.

How can I get a loan with just my pay stubs?

Usually, pay stubs are all you need to get a payday loan. However, there are many personal loan lenders that require just proof of income (pay stubs) and a few other pieces of information (like your Social SEcurity number) in order to qualify for a loan. These are far better options for most people.

What are three alternatives consumers should consider before using payday loans?

If you're considering a payday loan and thinking about alternatives, there are far more than three to consider. However, some of the best and lowest-interest payday loan alternatives are a home equity line of credit, a personal loan (even a bad credit personal loan), or a credit card. Although credit cards also carry with them high interest rates, these are still much less than what you pay on a payday loan.

Are payday loans hard or easy to pay back?

Payday loans are extremely difficult to pay back. They're harder to pay back than a traditional loan because most lenders won't take the time to verify your ability to repay before lending you the money you need.

The premise behind a personal loan is that you are meant to pay it back within two weeks (or whatever the loan term is). Once that two weeks ends, very few people actually have paid back their payday loans, and then the interest starts to kick in. Interest on these loans is high – some have rates of more than 398%!

Are payday loans ever a good idea?

Payday loans are seldom a good idea because they are meant to trap you in a never ending cycle of debt. It might seem like you have no other option, but a payday loan is almost guaranteed to leave you in far worse shape than what you began.

If you find yourself in an emergency situation and are considering a payday loan, stop to consider all of your options.

While payday loans are fast and convenient, you can often get a personal loan in the same amount of time (and with the same amount of effort). Visit Acorn Finance to check offers from top national lenders within 60 seconds or less. Checking offers does not impact your credit score.

Can payday loans hurt your credit?

Yes. Payday loans can hurt your credit. This is one of the biggest risks of taking out this type of loan. If you take out a payday loan and fail to pay it back on time, you could find yourself saddled with even more debt than you had to start with. Since payday loans have astronomical interest rates, it's easy to dig yourself a serious financial hole with even one missed payment.

What is the difference between a personal loan and an installment loan?

An installment loan is technically a type of personal loan. It is meant to be repaid over a formerly agreed-upon time period, with a specific number of scheduled payments.

Is payday loan variable or fixed rate?

Payday loans are usually meant to be paid off in a single lump-sum payment rather than monthly installments (though this doesn't always happen). Therefore, they are usually fixed rate loans.

If you find yourself in a difficult financial situation and need access to cash quickly, there are other options available to you. Try some of these tips discussed to get started on finding the funds you need. Each of these methods has its own set of pros and cons, so be sure to do your research before deciding which option is best for you. In most cases, personal loans can offer a lump sum of cash quickly with reasonable interest rates.

Did your search for a fast loan lead you to the idea of a payday loan? While payday loans are known for quick funding, they are also known for high-costs and small amounts. Most only require proof of identification, income, a bank account, and to be repaid on or before your next paycheck, and funds can be deposited right to your account. However, there might be some things making you wonder if alternatives to payday loans exist, and what might make sense, especially for fast funding. Perhaps it’s the cost or low amounts making you hesitate, regardless of the reason, understanding all available options can help you make an educated decision. Whether you have excellent credit or bad credit, we will help you explore payday loans and potential alternatives.

What is a payday loan?

Payday loans are loans that need to be repaid on or before your next paycheck. You might have assumed something like that by the name. While that might sound like the perfect solution, they are high-cost loans and are usually only available for $500 or less. If you’ve found yourself in a tight spot in between pay periods, you could use a payday loan, but consider how much will be deducted from your next paycheck. With high costs, payday loans can temporarily provide the money you need, but set you back in the long-run. Individuals with bad or little to no credit are usually the market for payday loans. Most only require proof of identification, income, a bank account, and to be repaid on or before your next paycheck, and funds can be deposited right to your account. However, if you’re using payday loans as a way to access cash, you might not be bettering your financial future. Exploring alternatives that can help boost credit score, might help you more in the long run. While situations can vary, we encourage borrowers to learn as much as they can about credit and how options work, in order to make better decisions. Hence our platform that allows individuals to check personal loan rates from multiple lenders in one place, with no credit score impact. With more offers, you have more opportunity to find exactly what you’re looking for. As a source that’s truly here to help, let’s continue to learn about payday loans so you can decide if they are right for you.

See also: What is a payday loan?

How does a payday loan work?

The idea of a payday loan is to get cash in the hands of individuals quickly, that is to be repaid from their next paycheck. To get a payday loan, you’ll likely need to prove you have a stable income, along with other basic information. Some states prohibit payday loans, so before pursuing one, that’s a good place to start; make sure they are available where you live. In exchange for the quick loan, you can expect to pay a high fee, which is something else states might regulate. While the costs are high, Americans often use payday loans for various reasons. One of those reasons might be a lack of knowledge on what else is available - something we hope to help you better understand. However, we also want to help you understand payday loans and how they work, in the event you feel a payday loan is the right option for you. Here are 6 steps usually involved with getting a payday loan.

- Determine there’s a need & ensure the state you live in allows payday loans

- Find a financial institution that offers payday loans (i.e. bank, credit union, online)

- Apply for a payday loan (remember, they are usually capped at about $500, which can vary by state)

- Approval (While the lender might not check your credit, they usually want to ensure you can repay the loan and are who you say you are.)

- Receive funds

- Repay the loan (they are usually 2 week loans)

How much do payday loans cost?

Payday loans can vary depending on the APR, fees, the loan amount, and other details. For every $100 borrowed, you usually pay about $15 dollars to borrow the money for a 2-week loan. Because the loan is short, a 15% finance charge can equate to a nearly 400% APR. Compared to credit cards, payday loans are usually a costlier option. APRs on credit cards usually range between 12% to 30%. From a short repayment period to high cost and low loan amount, payday loans may not solve your financial challenge. Opting for a longer loan with a higher loan amount, and hopefully lower cost can help you come out ahead. While your credit card might fit that definition, it can be challenging to pay down a credit card balance as interest continually accrues. Consider using a personal loan instead with fixed monthly payments for a predetermined period.

Is a payday loan secured or unsecured?

Payday loans are usually unsecured. While you’ll likely need to promise to repay the loan from your next paycheck, you probably will not have to put up collateral, too. That means if you have credit challenges, and no collateral, you might end up thinking about a payday loan . And, you’re probably be able to get one with few other requirements to meet. While this might solve a temporary issue, it’s not a long term fix. Working to rebuild your credit, which can sometimes be done using secured loans, such as a secured credit card, can improve your financial health down the road. In the midst of our busy lives, it’s important to make time to focus on finances. While we aren’t all sophisticated finance gurus, we can be, especially with the resources at our fingertips. From credit monitoring apps to trusted blogs and podcasts, education is everywhere. The first step is being open to it. In the world of loans, there are usually two main types: unsecured and secured.

- Secured loans: Require collateral.

- Examples: Home equity loan, pawn shop loan, and auto loan.

- Unsecured loans: Do not require collateral.

- Examples: Personal loan, credit card, and payday loan.

Within various types of loans, some are reported to major credit bureaus, and others are not. Loans that are not reported might not work to leave a positive remark on your credit history if you repay on time. So, next time you need to borrow, you might face limited options again, if you have credit challenges. Payday loans are usually not reported, so while they might provide you fast cash, they will likely not help improve your credit or borrowing history. In the unsecured category, loans like personal loans are usually reported to major credit bureaus and can work to improve your credit if you borrow responsibly. Whenever possible, think about the pros and cons of taking a loan, beyond just getting the money you need, when you need it.

How do payday loans affect your credit?

Payday loans are unlikely to impact credit score, since they are usually not reported to major credit bureaus. However, if you fail to repay a payday loan, it can impact your credit. Payday loan lenders can sell the loan to a debt collector who might report the collections account to national credit reporting companies. Payday lenders can also bring lawsuits to collect money owed. If you lose, these too can impact your credit score.

There are three major credit bureaus:

- Experian

- TransUnion

- Equifax

At Acorn Finance, all of our lending partners report loans to major credit bureaus. With a network of lenders that offer personal loans, you can find an offer that works best and receive funding on approved loans in as little as 1-2 business days. Thinking ahead, you can potentially improve your credit score if you make on-time payments.

What are some alternatives to payday loans

Alternatives to payday loans may prove themself to be the better option, but we’ll leave that to you to decide. Let’s review some alternatives so you can find the right loan, afterall, that’s what we’re all about.

- Personal loans: Personal loans can be offered up to $100,000, depending on credit score. The available amounts can also depend on what the lender can offer in general. For example, most have minimum and maximum loan amounts that applicants must qualify for. Personal loans are installment loans that are approved based on a borrower’s creditworthiness. They are usually funded as a lump sum that is to be repaid in fixed monthly installments over a predetermined period. Personal loans are a good alternative for borrowers looking to build their credit and or borrow more money, over a longer period. Check rates for personal loan offers with no credit score impact at Acorn Finance today.

- Credit card: If you need to borrow cash for a few weeks, a credit card might be a good alternative. If you don’t already have a credit card with available spending, you’ll need to apply and qualify, which can take some time. Additionally, it can be difficult to pay down credit card balances because of how they accrue interest. With a fixed rate and fixed payments such as a personal loan, you know exactly how much you need to pay and for how long.

- Friend or family member: You might be able to borrow money from a friendly or family member. While you’ll want to think about this option, as it can put strain on a relationship if things don’t go as planned, it can be a smart option if it works out.

How do you get a payday loan?

You can find payday loans through some banks, credit unions, payday lenders with storefronts and or online services. If payday loans are not allowed in your state, you won’t be able to find legitimate payday loans.

Why you shouldn’t get a payday loan

There are a few reasons you might want to avoid payday loans.

- Very short loans (usually 2 weeks)

- Small loan amounts (maximum amounts can vary by state)

- High fees

- Might not be reported to credit bureaus

Are payday loans legal?

In some states, payday loans are not legal. Some states that prohibit payday loans include New York, Arizona, West Virginia, and Pennsylvania. The regulation around payday loans, and lending in general, is usually intended to help borrowers avoid the debt trap. Oftentimes, individuals borrow money to meet basic living needs. With rising costs, debt traps are common for Americans. While some states prohibit payday loans, other states regulate what companies can charge and or require of the borrower. Familiarize yourself with what your state allows before getting a payday loan to ensure the payday lender is compliant. For example, in California the maximum payday loan amount is $300 and the maximum fee is 15%. Because lenders usually want to profit as much as possible, you may see the maximum fee charged. It might be worthwhile to consider alternatives.

What are no denial payday loans?

You might see some payday loans advertised as no denial or guaranteed. And while that sounds like a sure bet, it might not mean what you assume. Some may be guaranteed, they are usually guaranteed in the sense that the lender will do their best to get you a loan, regardless of your credit score. It’s important to read fine print and ask questions to understand what things mean, as they may not always mean what you assume they mean. When it comes to borrowing money, there are usually some requirements that need to be met. Afterall, would you just give someone $100 dollard, give or take, without knowing anything about them or their ability to repay? Probably not, and lenders feel the same way usually.

Can I get more than $255 for a payday loan in California?

Some states have regulations around payday loans, including capped fees and loan amounts. Some states may not allow payday loans at all. In California, qualified applicants can get a payday loan more than $255, but not by much. Payday loans in California are capped at a $300 maximum. California payday laws are intended to protect consumers. They enforce things such as requiring payday lenders to be licensed with the Department of Financial Protection and Innovation. Additionally, in California payday lenders can only issue one loan at a time per consumer with a maximum fee of 15% of the total amount of the check (not to exceed $45). They may charge bounced check fees of up to $15. Regulations can change, but as a consumer you should find a credible source to read up on payday loans before getting one. While you may only be borrowing a small amount, it’s important to know what’s legally permissible.

Can I get a payday loan with bad credit?

Payday loans usually don’t require a credit check. In most cases, they only require proof of income, identification, and a bank account. While this may sound like the perfect solution to borrowing money with bad credit, most would tell you to proceed with caution. The cycle of bad credit can feel like a trap. But, there are some lenders, who believe you are more than just a credit score, like our lending partner OneMain Financial. Taking action to find ways to improve your credit score can help you in the long run. In the interim, check your credit report. Consider using a credit monitoring service that can provide recommendations on improving your credit score. Perhaps there are things bringing your score down that you are not even aware of. Monitoring your credit is a great way to learn how it’s impacted, which alone, can help you make more mindful financial decisions moving forward.

At Acorn Finance, you can check personal loan offers with no credit score impact. Therefore, if you lack confidence about qualifying, you can check offers in the privacy of your own home without impacting your credit score. Some of our lending partners even allow you to apply with a co-signer which can increase your chance of approval in some cases.

Related loan articles:

Other Bad Credit Loans

- Loans for Teachers with Bad Credit

- Long-term Personal Loans For Bad Credit

- Pet Loans For Bad Credit

- Christmas Loans For Bad Credit

- Personal Loans For 570 Credit Score - Bad Credit

- Land Loans For Bad Credit

- Holiday Loans For Bad Credit

- Personal Loans For Bad Credit

- Personal Loans for Credit Score Under 550 - Bad Credit

- Personal Loans For 520 Credit Score - Bad Credit

- Bad Credit Personal Loans for 500 Credit Score

- Bad Credit RV Loans

- Debt Consolidation Loans For Bad Credit

- Emergency Loans For Bad Credit

- Bad Credit Loans In Texas

- Loans for Postal Employees with Bad Credit

- Car Repair Loans with Bad Credit

- Loans for Uber Drivers with Bad Credit

$10000 Loan Calculator

Find the loan you're looking for

What can I do with a $10,000 personal loan?

Still have questions?

One home, endless possibilities