Personal Loans for Stay at Home Moms

Compare monthly payment options from several lenders in under 2 minutes.

How much would you like to finance?

Best Personal Loans Options for Stay at Home Moms

There is no way to sugarcoat this, if you are a stay-at-home mom with zero income, it may be difficult for you to obtain a personal loan. One of the main criteria that lenders look at aside from your credit score is income. However, there are still many ways that could make obtaining a personal loan possible.

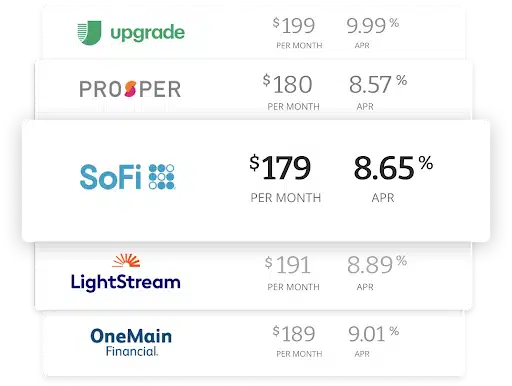

Compare rates from top lenders

Learn More About Personal Loans for Stay at Home Moms

The main requirements for a stay-at-home mom with no income to obtain a personal loan is either they have a cosigner like a spouse, sibling, or a parent, or that they have an asset that they can use as collateral. For example, maybe you have a vehicle that is completely paid off and in your name.

Read more - FAQ

+Can I get a personal loan as a stay at home mom?

There is no way to sugarcoat this, if you are a stay-at-home mom with zero income, it may be difficult for you to obtain a personal loan. One of the main criteria that lenders look at aside from your credit score is income. However, there are still many ways that could make obtaining a personal loan possible.

Maybe you are a divorcee who receives alimony and/or child support. Remember that alimony and child support should be reported as income when you are applying for a personal loan. If you are still married, you should try to seek a lender who lets you claim your household income instead of your individual income. By using your household income and your spouse as a cosigner, you then can demonstrate to a lender that you do have money coming in each month that will be sufficient enough to make the monthly payments of a personal loan on time and in full.

Another way to secure a personal loan as a stay-at-home mom is to use an asset as collateral. Lenders may be able to consider lending out a sum of money to someone with no income if they knew that you had an asset that they could use to cover the loan if for some reason you are unable to make the monthly payments and you eventually default on the loan. A few assets to consider that you may have to secure a personal loan include a vehicle that you own and that is in your name, a retirement account that maybe you were able to maintain before you became a stay-at-home mom or some jewelry that you own that has some considerable financial value.

Can you use the household income for a personal loan?

Yes, if you are married, you can use your household income to obtain a personal loan in the form of using your spouse as a cosigner. You may find it extremely difficult to claim your household income on a loan application without having your spouse fully on board as a cosigner. The good thing about having your spouse as a cosigner is that if they have good credit, your chances to qualify may be pretty good and as you make your monthly payments, you will continue to build your credit history and increase your credit score.

What are the requirements for a personal loan as a stay at home mom?

The main requirements for a stay-at-home mom with no income to obtain a personal loan is either they have a cosigner like a spouse, sibling, or a parent, or that they have an asset that they can use as collateral. For example, maybe you have a vehicle that is completely paid off and in your name. You may be able to use your vehicle as collateral to secure the loan. Just make sure you continue to make the monthly payments on time and that you do not default on the loan. If you default, then you might lose your only mode of transportation outside of taking a bus or other form of public transportation. In some areas of the country, living without a personal vehicle is totally a viable option, but in less urban areas where public transportation is sparse, it may create some considerable headaches for you to get your grocery shopping or other errands done. Also, if you use any of your jewelry or gold and diamonds as collateral, you will want to make sure you keep up-to-date on your loan payments or risk losing the jewelry. If a lender repossesses your jewelry, that could feel worse if it happened to be a family heirloom inherited from a grandmother or another family member. Either way, using collateral is risky, but if you are confident you can cover the monthly payments, then it may be a risk you are willing to make to secure the upfront financing you need.

How can I get a loan with no income?

If you are looking for a loan but you have no income, you can explore a few different options. If you own your home and have some equity built-up, you may be able to borrow against your home's equity. If you have a retirement or CD account, you may be able to borrow against the accounts contents with no penalty if the loan amount is paid in full on time. As always, if you are looking for a personal loan with no income, you can always use collateral or a cosigner to secure the loan.

What credit score do I need for a personal loan as a stay at home mom?

Depending on if you have a cosigner or if you are using collateral to secure a loan, minimum credit score requirements may vary by lender. If you have a cosigner with a good to exceptional credit score, you may be able to qualify for a personal loan even with a credit score of 600 or lower. Additionally, if you are using collateral to secure a personal loan, depending on the value of the asset, you may be able to qualify for a personal loan with little or no credit. Lenders that have access to an asset that has some significant financial value may be willing to be more forgiving about an individual's income and credit history.

How much can I borrow with a personal loan as a stay at home mom?

If you have a cosigner, or collateral, a stay-at-home mom could borrow up to $100,000 using a personal loan. Obviously it will all depend on credit history, income, and other requirements a lender may have. It can also depend on the lender as lenders usually have specified loan amounts they can offer.

Is a personal loan the best way to borrow money as a stay at home mom?

A personal loan may be an option for a stay-at-home mom to borrow some money in the form of a loan. Another option that a stay-at-home mom could consider is a 0% interest introductory credit card that uses household income rather than personal income to determine eligibility.

How do I get a personal loan for stay at home moms?

If you have a cosigner or collateral available to help you secure a personal loan, you may want to consider shopping for a personal loan online. Online lenders have a considerable amount of flexibility to work with stay-at-home moms to help them secure the financing they need.

Where can I get a personal loan for stay at home moms?

If you are a stay-at-home mom looking for a personal loan, the first place you may want to look is online. The online lending marketplace is a huge market that has many options out there available for people with all different credit and income situations.

Why choose Acorn Finance for personal loans?

Acorn Finance can help borrowers find the best personal loan offer while saving them time, money, and hassle too. With a network of top-rated national lenders, borrowers can check offers within 60 seconds or less without impacting credit score. After comparing offers, you can choose the one that works best and complete the process with the lender. Once your loan is approved, funds may be deposited in as little as 1 to 2 business days, although funding times may vary.

$ Loan Calculator

Find the loan you're looking for

What can I do with a $2,000 personal loan?

Still have questions?

One home, endless possibilities