Types of Personal Loans

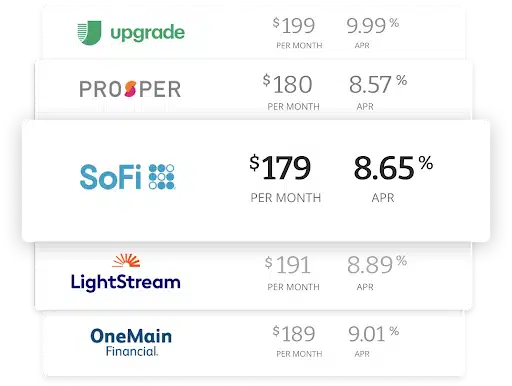

Compare monthly payment options from several lenders in under 2 minutes.

How much would you like to finance?

Different Types Of Personal Loans

Most consumers who apply for a personal loan are taking out an unsecured loan. Unsecured personal loans are structured as a form of installment loan where equal monthly payments are made during a set repayment period to spread out the burden of paying off the debt. Unsecured personal loans are the most common form of personal loan. Unlike other forms of financing where your personal assets may be used to “back up” or secure the loan, unsecured personal loans rely on your creditworthiness to determine the outcome of your application.

When compared to secured personal loans, the application process for an unsecured loan is much simpler, and most importantly you do not run the risk of losing your assets or collateral.

Explore all the things a personal loan can do for you today at Acorn Finance.

Compare rates from top lenders

$ Loan Calculator

Find the loan you're looking for

What can I do with a $2,000 personal loan?

Still have questions?

One home, endless possibilities